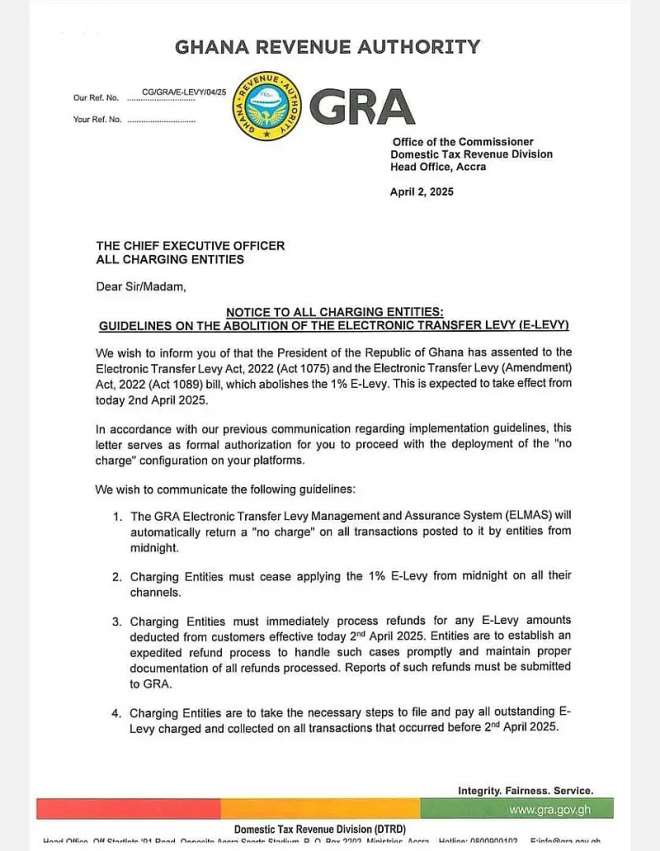

The Ghana Revenue Authority (GRA) has officially directed all charging entities to cease applying the 1% Electronic Transfer Levy (E-Levy) from midnight of April 2, 2025.

This follows President John Mahama’s assent to the Electronic Transfer Levy Act, 2022 (Act 1075) and its Amendment Act, 2022 (Act 1089), effectively abolishing the controversial tax on electronic transactions.

In a statement issued by the Domestic Tax Revenue Division (DTRD), the GRA confirmed that its Electronic Transfer Levy Management and Assurance System (ELMAS) will automatically update all transactions to reflect a “no charge” status, ensuring compliance across financial platforms.

The directive further mandates that charging entities must immediately halt E-Levy deductions and process refunds for any amounts charged after the effective date. Companies handling these transactions are also required to maintain proper records of all refunds processed and submit detailed reports to the GRA.

Additionally, the authority has instructed charging entities to settle any outstanding E-Levy amounts collected before April 2, 2025.

The abolition of the E-Levy comes after widespread public opposition since its introduction in 2022. Initially set at 1.5%, the levy was later reduced to 1%, yet it remained unpopular among businesses and individuals who felt it placed an extra financial burden on digital transactions.

The move to scrap the tax is expected to boost financial inclusion, encourage digital payments, and ease economic pressure on Ghanaians. The GRA has assured the public that measures are in place to ensure a smooth transition and compliance with the new directive.