Former Member of Parliament for Odododiodio, Edwin Nii Lante Vanderpuye, has argued that the now-abolished 1% Electronic Transaction Levy (E-Levy) was designed in a way that disproportionately affected the poor, ultimately deepening the poverty cycle.

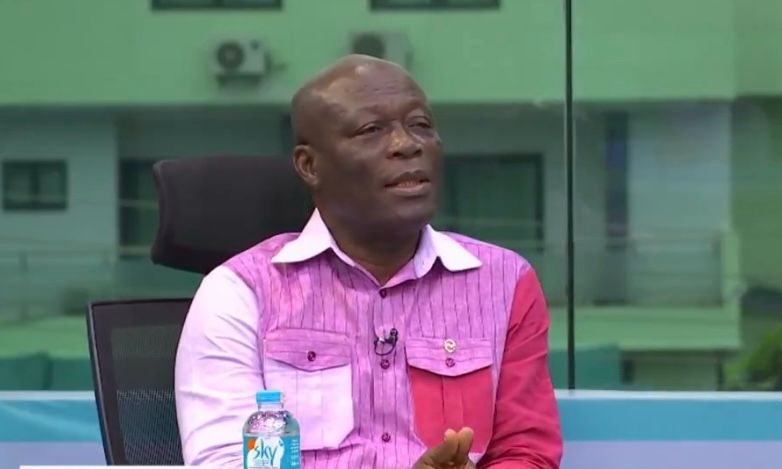

Speaking in an interview on Accra-based Channel One TV on Thursday, April 3, the Coordinator of the District Road Improvement Programme (DRIP) asserted that the tax only placed an additional burden on Ghanaians already struggling with economic hardships.

“The E-Levy, right from its introduction, was widely criticized, especially because it was seen as a tax that would hurt the poor more than the rich. I remember the former Vice President sitting in a television studio and admitting that electronic transaction taxes were mostly paid by poor people. So, why tax them? When we continue with such taxes, we only deepen the poverty cycle,” he stated.

Vanderpuye also defended the decision by President John Dramani Mahama to abolish the E-Levy, noting that it failed to achieve its intended purpose.

“A lot of people said President Mahama couldn’t remove the E-Levy because of the IMF program and other factors. But as pragmatic as he is, together with his Minister of Finance, they found innovative ways to plug the revenue gap that would have been created by scrapping these taxes,” he said.

According to him, the revenue generated from the levy fell far below expectations.

“Well, what was the E-Levy intended to do? Its main purpose was to raise revenue. Did it raise the required revenue in the first year? It was poorly implemented, and I said from the onset that it wouldn’t generate much. It didn’t even achieve 50% of its projected revenue in the first year, and in the second year, though it improved slightly, it still didn’t meet expectations,” he explained.

Vanderpuye stressed that if the government could generate the same revenue through alternative means without placing an additional burden on the poor, then maintaining the tax made no sense.