The cedi has been rated among the world’s best-performing currencies in recent weeks, drawing praise from businesses and policymakers alike.

However, a new policy discussion paper by the Centre for Policy Scrutiny (CPS), titled ‘Ghana’s Cedi Holds Steady – But Can the Calm Last?’, cautions that this impressive run may be more fragile than it appears, and urges urgent structural reforms to make the gains sustainable.

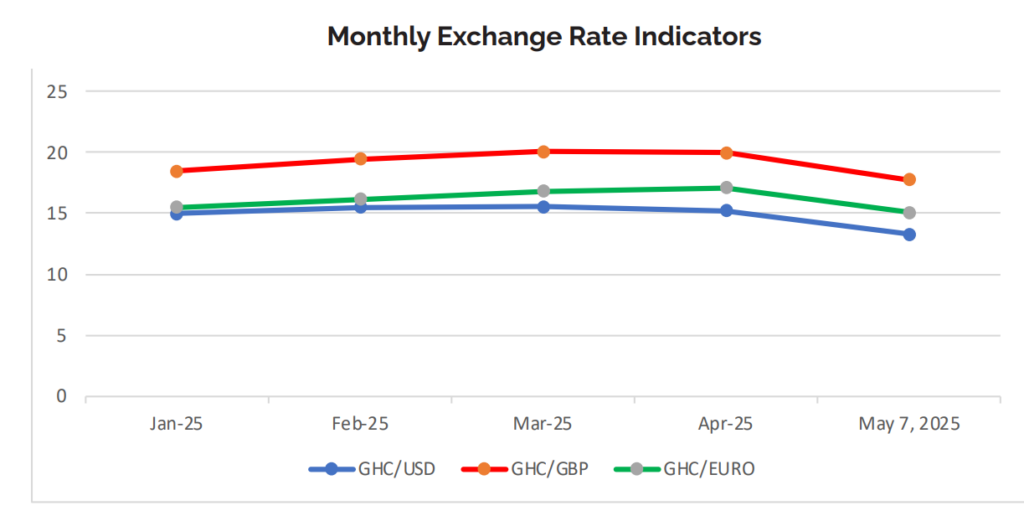

According to CPS, the cedi’s appreciation—rising from GH¢15.50 to the U.S. dollar in mid-April to GH¢13.30 by May 7—has been underpinned by both global and domestic factors, including a weakening U.S. dollar, improved gold and international reserves, reduced government spending, and investor optimism.

However, the think tank argues that these drivers may not be sustainable in the medium to long term unless backed by deeper economic reforms.

“The cedi’s recent appreciation is encouraging, but many of the factors behind it—such as lower debt servicing and constrained public expenditure—are temporary,” the paper notes, adding that “Without comprehensive structural policies, the cedi’s strength may be short-lived.”

Respite for business, but caution lingers

The Ghana Union of Traders Association (GUTA) has lauded the Bank of Ghana and the government, saying the cedi’s stability has significantly boosted business confidence.

With the exchange rate volatility easing, many import-dependent businesses report better pricing predictability and a potential recovery of lost capital.

A strong cedi also appears to be aiding the inflation fight. CPS notes that imported inflation has been easing, contributing to a downward trend in overall inflation since January. “Ghanaians may begin to see some cost-of-living relief,” it says.

International investors are also taking notice. With gross international reserves rising to $9.4 billion as of March—up from $6.2 billion a year prior—Ghana is viewed as a more stable and creditworthy destination for capital.

Despite the current optimism, the CPS warns that the cedi’s newfound strength is not without consequences or risks. A stronger currency, it argues, can harm export competitiveness by making Ghanaian goods more expensive abroad.

There is also the risk of import surges, which could undermine local industries and widen the trade deficit.

Another pressing concern is the reduced value of foreign remittances.

“As the cedi strengthens, families relying on support from abroad receive less in local currency. This could dampen household consumption and slow domestic demand,” CPS cautions.

The biggest threat, however, according to CPS, lies in sustainability, and to safeguard the gains, the think tank recommends a multipronged strategy:

Expand domestic gold purchasing: The Bank of Ghana’s gold reserves have surged from 8.78 tonnes in 2023 to 31.37 tonnes in April 2025—a 257% increase. CPS urges the government to scale up this effort to further shore up the cedi.

Prioritise import-substitution: Ghana must reduce its dependence on foreign goods by accelerating the implementation of local production policies, the paper stresses.

Reinforce fiscal discipline: CPS calls for stricter controls on public expenditure and improved domestic revenue mobilisation to prevent excessive deficits that could weaken the currency.

Maintain tight monetary policy: Keeping inflation and liquidity in check will be key to supporting long-term cedi stability.

The CPS’ paper points to the fact that while the cedi’s current position is commendable, it is no time for complacency. CPS argues that the “Stability of the cedi is non-negotiable,” and that “It is time for bold policy choices—not to defend the currency at all costs, but to make it sustainably strong.”

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.