The US dollar has seen big declines in recent months.

Currencies rise and fall all the time, but the recent drop in the dollar has been particularly dramatic.

So why has the dollar been falling, and why does it matter?

What has happened to the dollar since Trump was elected?

The dollar was rising in the autumn in the run-up to the 2024 presidential election off the back of relatively strong US economic growth, and continued to strengthen after Trump’s victory in November on hopes he might extend that trend.

Talk of his trade policy also had an effect, as many investors thought the tariffs that he promised to bring in would push up inflation, forcing the US central bank, the Federal Reserve to raise interest rates, or at least not cut them as fast as expected.

The prospect of higher rates in the US makes the dollar more attractive as it means investors will make more money on their cash in dollars compared to other currencies.

But the calculus has shifted in recent months as the details of his tariffs have emerged – often followed by pauses or, in the case of China, extensions – leaving much uncertainty surrounding the impact they will have.

US growth is now widely expected to weaken.

That has had a knock-on impact on the dollar, which has seen steep falls. Trump’s attacks on Fed chief Jerome Powell for not cutting interest rates also appear to have added pressure to the greenback.

The value of all currencies goes up and down influenced by many factors such as inflation expectations and central bank policies.

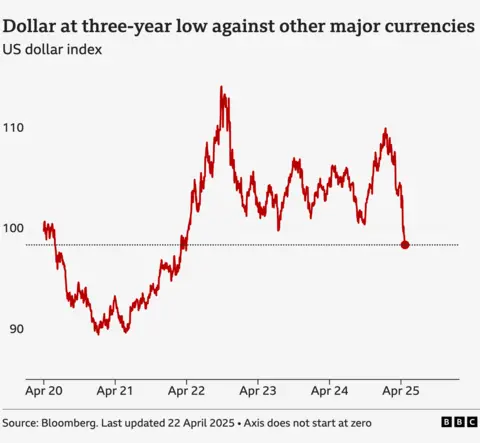

But the dollar index, which measures its strength against a set of currencies, has fallen to its lowest level for three years.

Is this unusual?

The dollar is usually seen as a safe investment in troubled times.

So the sharp drops in the currency – as well as the recent sell-off in US government bonds, also generally considered a safe US asset – are unusual.

The fall in the dollar after Trump’s “Liberation Day” tariffs announcement was “quite shocking”, says Jane Foley, head of foreign exchange (FX) strategy at Rabobank.

“For several years, the market’s been buying this US growth story, the US stock market’s been outperforming other stock markets, and suddenly you had economists thinking tariffs would push the US into recession,” she says, pointing to the massive sell-off of US stocks, US bonds and the dollar.

That has raised speculation about whether the drop might signal a more far-reaching turn away from the US, as well as away from the dollar.

What does a weaker dollar mean?

The first time ordinary Americans might notice a weaker dollar is when they go abroad, as their money will not go as far. While foreign tourists in the US will find their currency will buy them more.

But movements in the dollar also have a massive impact internationally, more so than swings in other currencies do.

That’s because it is the world’s primary reserve currency, meaning it is held by central banks around the world in large quantities as part of their foreign exchange reserves. Central banks use US dollars in international transactions, to pay for international debt, or to support domestic exchange rates.

The dollar is also the main currency used in international trade, with around half of world trade invoices done in US dollars, says Jane Foley.

A fall in the dollar means US goods exports become cheaper. But imported goods may become more expensive due to the weaker currency, as well as any direct impact from tariffs.

Many commodities that trade internationally, such as oil and gas, are also priced in dollars. A weaker dollar makes crude oil cheaper for countries that hold other currencies.

What happens if the dollar keeps falling?

In the US a strong dollar has been seen as a symbol of American political might.

The very idea that it might lose its status as the world’s reserve currency has been unthinkable.

Ms Foley says that while other currencies may become more important, the dollar won’t lose its number one status any time soon, although one Federal Reserve official suggested last year that the US can no longer take this for granted.

Ms Foley thinks the dollar will win back some ground over the next few weeks but will not get back to where it was.

That’s because with very significant market moves, there’s always the possibility of profit taking. For instance, if investors decide to sell euros while they’re trading strongly, that could lead to the euro falling and the dollar rising.

The markets will be watching this week to see if Trump continues his attack on the head of the Federal Reserve. He has called Mr Powell “a major loser” and has publicly called for his “termination”.

If there is pressure on Powell to leave office, the markets will start to wonder about the Fed’s credibility, something which is seen as crucial.

“The independence of central banks is seen as critical to ensure long-term price stability, ringfencing policymakers from short-term political pressures,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.