The adoption of mobile phones for financial transactions—commonly known as mobile banking or mobile money—has become a transformative tool for national development, particularly in low- and middle-income countries.

The 2021 Population and Housing Census (PHC) included questions aimed at understanding how mobile phones are utilized for financial activities.

According to the 2021 PHC Field Officers Manual, the purpose of these questions is to determine the number of individuals aged six years and older who engaged in mobile financial transactions at least once within the past three months.

What Constitutes Financial Transactions?

These include activities such as depositing money into bank accounts, borrowing funds, purchasing or selling goods and properties, and sending or receiving money via mobile devices. The manual also notes that if a person has used someone else’s phone for financial transactions within the reference period, it counts as usage—even if they did not operate the device themselves.

Key Findings from the 2021 PHC Data

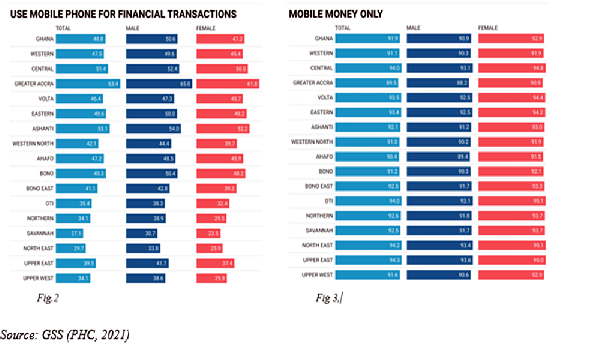

As depicted in Figure 1, approximately 49percent (48.8%) of the population aged six and above used mobile phones for financial transactions. Usage is slightly higher among males, with 50.6% compared to 47.2% among females. Interestingly, a larger proportion of females (92.9%) reported using mobile phones for mobile money only for financial transaction than males (90.9%).

Regional Distribution

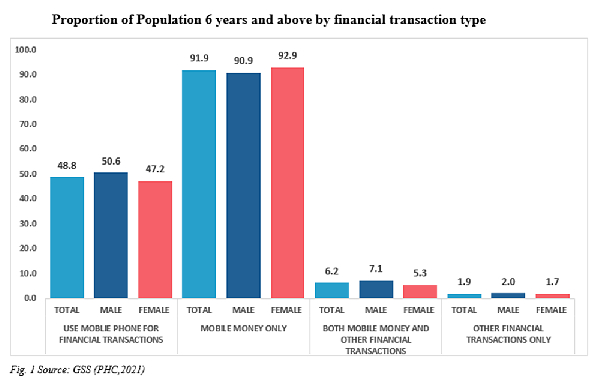

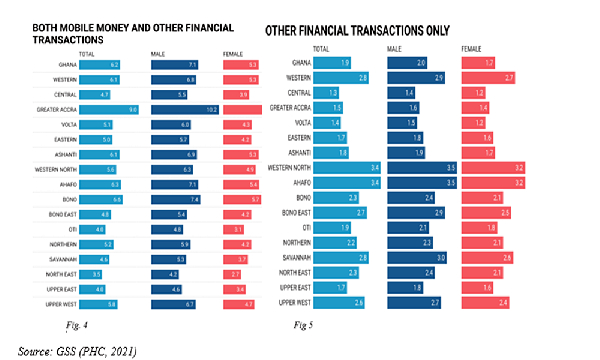

The data further reveals regional variations in mobile financial transaction usage (Figures 2 through 5), highlighting differing levels of adoption across the country.

Why Is Mobile Phone Use for Financial Transactions Crucial?

Mobile banking plays a vital role in fostering national development for several reasons:

1. Financial Inclusion

Expanding Access to Financial Services

Mobile phones enable underserved populations—especially in rural and low-income areas—to access banking services without the need for physical bank branches. These services include money transfers, savings, loans, and bill payments.

Implications:

• Reduces the number of unbanked individuals

• Empowers marginalized groups such as women, youth, and smallholder farmers

• Contributes to poverty reduction and greater economic equality

2. Economic Empowerment and Growth

Supporting Small and Informal Businesses

Mobile transactions facilitate daily business activities like receiving payments, purchasing inventory, and paying workers. They also promote entrepreneurship by providing easier access to credit through mobile loan applications—a benefit that has notably helped students finance their education.

Implications:

• Stimulates growth of small and medium enterprises (SMEs), key drivers of employment and GDP

• Enhances productivity and local economic development

3. Improved Efficiency in Government Services

Digital Public Payments and Transfers

Governments leverage mobile platforms to distribute social welfare, pensions, and emergency relief—such as the LEAP program—reducing costs and minimizing leakages associated with cash transfer schemes. Many government payments are now processed via online systems, increasing transparency.

Implications:

• Boosts efficiency and transparency in public service delivery

• Strengthens trust in government institutions

4. Advancement of the Digital Economy

Growth of FinTech and Digital Services

Mobile financial platforms drive innovation in digital finance sectors like insurance, credit scoring, and investments. They also facilitate e-commerce and digital trade, positioning countries competitively in the global digital economy.

Implications:

• Fosters new industries and job creation

• Enhances international competitiveness

5. Social Benefits

Empowerment and Resilience

Mobile financial tools help households manage risks and recover from shocks such as health emergencies or natural disasters. Savings and insurance features contribute to long-term financial planning and stability.

Implications:

• Increases household financial security and resilience

• Promotes societal stability and overall human development

Challenges and Policy Considerations

Despite its benefits, several barriers hinder the full adoption of mobile financial services:

• Digital and Financial Literacy: Particularly among older or less educated populations

• Cybersecurity Risks: Including fraud, identity theft, and data breaches

• Regulatory Gaps and Infrastructure Deficits: Especially in remote or underserved areas

Implications:

To harness the full potential of mobile financial services, national development strategies must prioritize investments in digital infrastructure, cybersecurity, public education, and inclusive policy frameworks.

Conclusion

Mobile phone-based financial transactions serve as a catalyst for national development by unlocking economic opportunities, improving governance, and fostering inclusive growth.

To maximize these benefits, governments must address challenges related to access, literacy, and regulation. When effectively managed, mobile financial services can transform economies and significantly improve lives.