The Ghana cedi (GHS) has performed remarkably this year against major currencies, particularly the US dollar (USD), reaching 11.85 GHS/USD as of May 21st, 2025. This is not surprising; Bloomberg has recently ranked the Ghana cedi as the world’s best-performing currency. However, can the cedi sustain this gain until November 2025? And what policies should Ghana implement to avoid any currency collapse?

In this article, I address these questions using the historical GHS/USD exchange rate data from January 2, 2020, to May 21, 2025, from the Bank of Ghana and the 6-month moving average prediction model for the forecasting analysis.

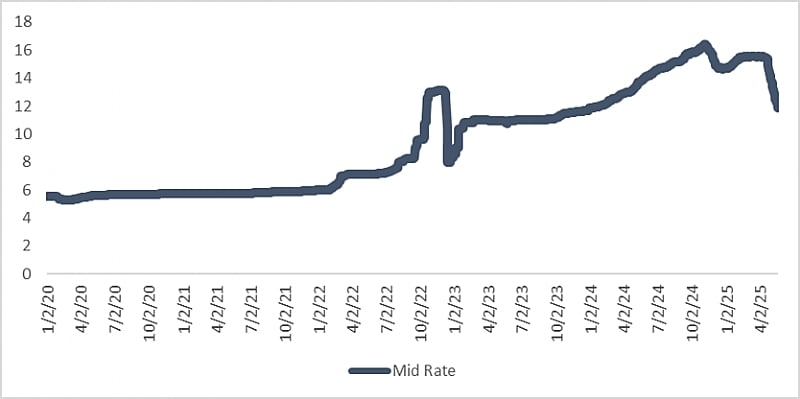

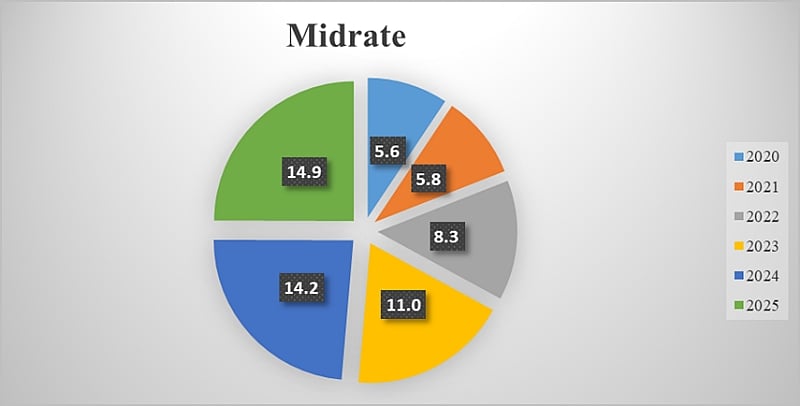

Figure 1 illustrates the GHS/USD trend from January 2, 2020, to May 21, 2025. This trend shows that, on average, the rate has been continuously increasing from 5.5 in January 2020 to 12.8 in May 2025. In 2020, the rates were stable at around 5.6 GHS/USD, showing moderate economic pressures before the pandemic. However, in 2021, the exchange rate increased to 5.8 GHS/USD, representing a mild 3.6% year-on-year depreciation. This marginal increase could be attributed to the COVID-19 pandemic. The depreciation continued into 2022, with rates reaching 8.3 GHS/USD by the end of December 2022, reflecting a further 43.1% yearly depreciation. This could also be attributed to the loss of access to international markets for sovereign borrowing. There was a sharp increase in the exchange rate from 8.3 in 2022 to 11 in 2023. This represented a 32.5% yearly depreciation. In 2024, the rate reached a record 14.2, representing 29.1% depreciation. In 2025, the average rate is currently 14.9 (see Figure 2); however, the cedi has appreciated by 14.7% from 15 GHS/USD in January to 12.8% in May.

Figure 1. Trend of Ghana cedi to the US dollar

Figure 2. Yearly average of Ghana cedi to the US dollar

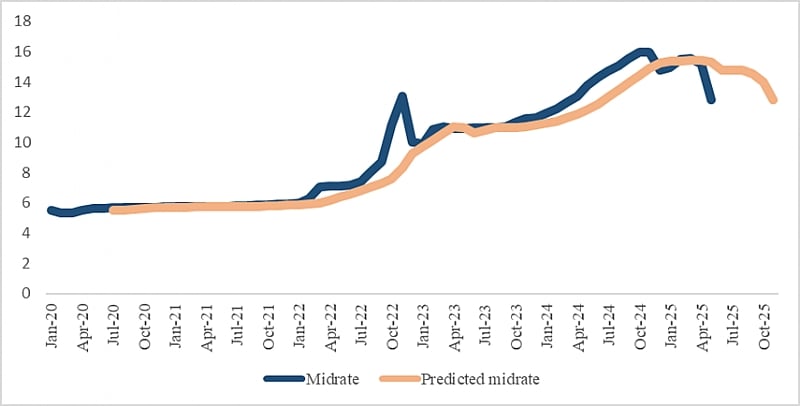

Figure 3 shows that the model accurately predicts the exchange rate over the period while projecting the rate to hit 14.8 in both June, July, and August, while dropping to 14.5, 14 and 12.8, respectively, in September, October, and November.

Figure 3. Predicted Ghana cedi to US dollar rate by November 2025

In conclusion, the cedi has depreciated by 166% since 2020; thus, to curb this depreciation, I propose the following measures. Firstly, policymakers should expand the gold-for-oil programme to cover other essential imports. Secondly, they should adopt currency swap agreements with major importing countries to alleviate the pressure on the USD. Additionally, policymakers should diversify suppliers within the local or regional market, leveraging the African Continental Free Trade Agreement. Furthermore, they should enhance the competitiveness of Ghana’s main exports. Therefore, the government should endeavour to add value to the cocoa and gold produced in the country. Lastly, policymakers should reduce the high interest rate, which often leads to elevated prices. This would result in lower prices while increasing domestic production and consumption, ultimately contributing to a reduction in the exchange rate.

About the author

Prof. Isaac Appiah-Otoo currently works as a full Professor at the College of Management Science, Chengdu University of Technology while equally serving as a lecturer at the Oxford Brookes University College affiliated to Chengdu University of Technology. He can be contacted at:

Facebook:

https://www.facebook.com/isaac.appiahotoo.7,

linkedIn: https://www.linkedin.com/in/isaac-appiah-otoo-ph-d-802909200/,

Researchgate: https://www.researchgate.net/profile/Isaac-Appiah-Otoo-2,

Email: [email protected]