In December 2015, a bold new chapter began in Ghana’s insurance industry. LeapFrog Investments, a global private equity firm known for its profit-with-purpose approach, made a strategic acquisition of miLife Insurance.

The vision was clear: inject innovation, capital, and global expertise to build a business that could drive both financial success and meaningful social impact.

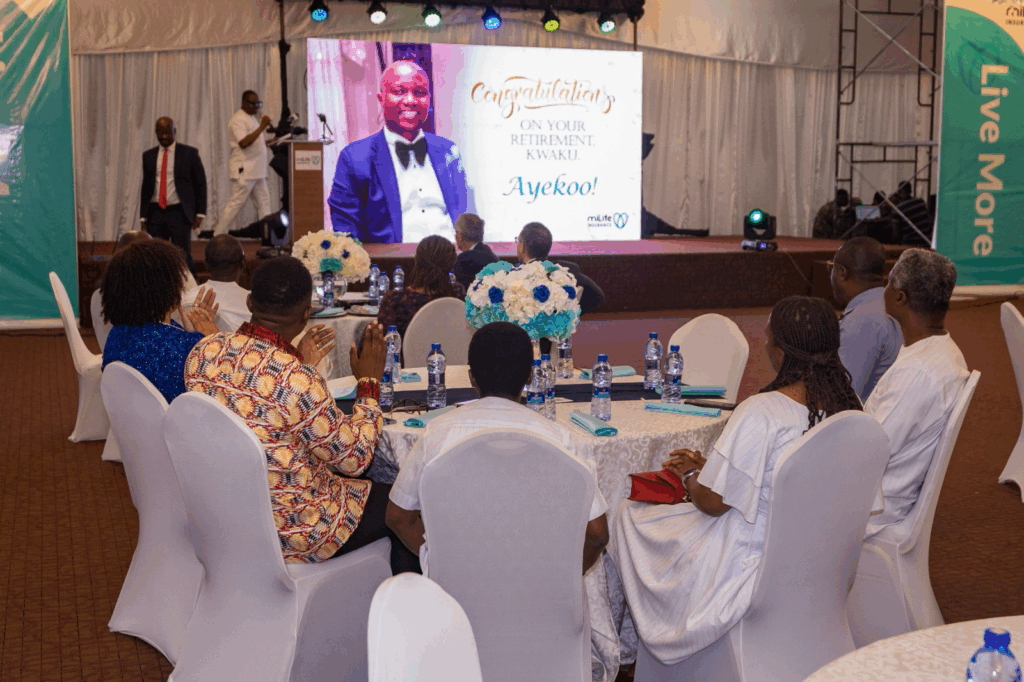

A month later, in January 2016, a seasoned professional with a quiet but commanding presence stepped into the role of CEO.

His name is Kwaku Yeboah-Asuamah. With a career spanning over two decades in insurance, finance, and pensions, Kwaku brought not just technical expertise but also vision, discipline, and heart.

Together with the broader management team and LeapFrog, what followed over the next nine years was nothing short of extraordinary.

A remarkable transformation

Under Kwaku’s leadership, the company experienced rapid and sustainable growth. In 2016, miLife’s annual premium income stood at under GH¢20 million, and by the end of 2024, that figure had soared to GH¢406 million—a staggering 21x growth. During this period, the company rebranded as miLife Insurance, a name that better reflects the company’s renewed vision, mission and values.

This phenomenal growth didn’t happen by chance. Kwaku led a strategic review of the company’s product offerings, ensuring they reflected the real needs of everyday Ghanaians. Under his leadership, the company expanded its distribution channels through partnerships with mobile network operators and community groups and placed a sharp focus on sales productivity. The result? A thirty-onefold increase in new business, with policies growing from 12,138 in 2016 to 375,535 in 2024.

Working closely with LeapFrog, miLife has implemented many value accretive initiatives, including the business rebranding, customer excellence, agency development and employee learning and development, to name a few

Profitability followed suit. Between 2016 and 2024, miLife recorded a cumulative underwriting profit of GHS 81 million and operating profits of GHS 97 million. Meanwhile, Assets Under Management grew from modest beginnings to GHS 459 million by December 2024, a testament to prudent investment, diversification, and financial stewardship.

Climbing the Ranks

These results have seen miLife command a greater presence in the country’s highly competitive market. miLife is now a top-five life insurer and has narrowed the premium gap to its competitors significantly, becoming a formidable force in a fast-growing industry.

A Digital Edge with Purpose

True to his forward-looking philosophy, Kwaku championed the use of technology not as a trend, but as a tool to drive inclusion, efficiency, and scale. Under his watch, miLife deployed transformative systems such as Adepa for sales, underwriting, and billing; Mankrado for claims automation; and Ohemaa, both a web self-service portal (ohemaa.milifeghana.com) and an AI-powered chatbot (050 352 6465) that brought customer support to the fingertips of policyholders nationwide.

These platforms significantly reduced human errors, sped up policy issuance, simplified claims processing, and enhanced customer engagement, ensuring that a lean IT team could deliver maximum impact across the company.

Kwaku did not merely adopt digital innovation, he ingrained it into the very fabric of miLife’s culture. Under his leadership, technology became a catalyst for impact, particularly in the micro-insurance space, where products like miWay (Dial *165# on MTN to sign up or manage your cover) and miFuture (Dial *462# on Telecel to sign up or manage your cover) experienced exponential growth. Each technology-driven initiative was purposefully designed to make insurance more accessible, dependable, and deeply human.

Putting Customers First

Kwaku’s legacy goes beyond numbers. From day one, he insisted that miLife must remain deeply connected to its customers. He didn’t just sit in the boardroom, he made regular appearances in the field. From Kasoa to Kintampo, he met with clients face-to-face, listening to their stories, answering their questions, and building trust.

He truly believed, his own saying that “insurance is only as valuable as it is understood”. That belief shaped miLife’s customer education strategy, which included community forums, local language radio shows, digital campaigns, and in-market activations, which are all aimed at demystifying insurance and empowering people to make informed decisions.

This hands-on leadership style not only sets miLife apart from its Ghanaian peers but also builds a culture where customer engagement and service excellence have become non-negotiable.

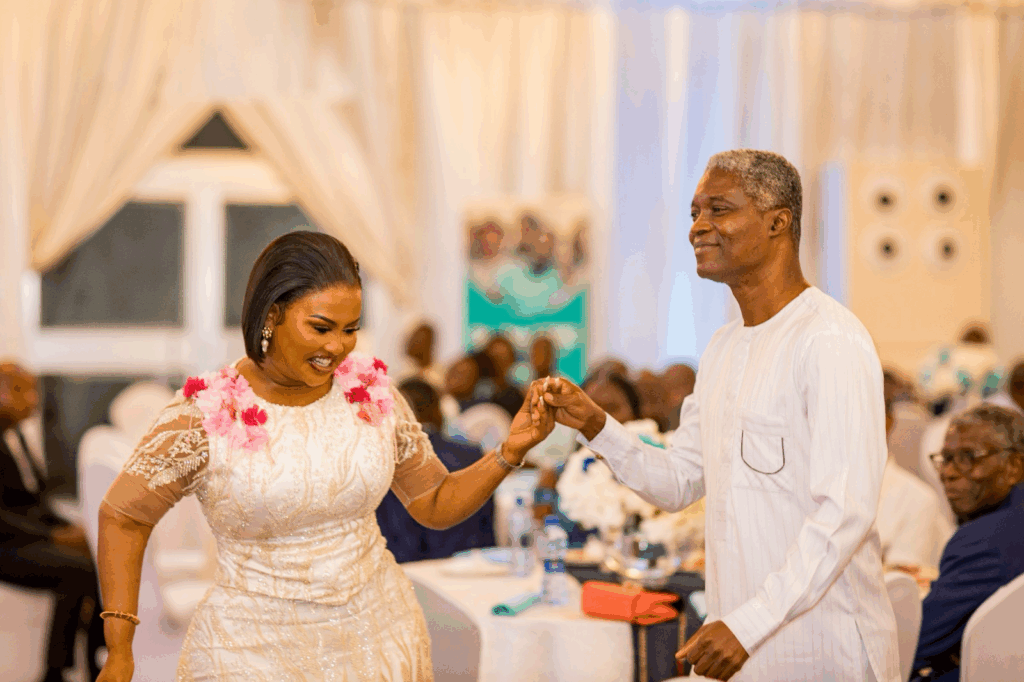

A Culture of People and Purpose

Under Kwaku’s leadership, a strong and distinct organisational culture took root, one that prioritised employee engagement, motivation, and job satisfaction. He believed that a company’s greatest asset is its people, and his leadership consistently reflected that belief. His values and strategic priorities shaped not only miLife’s business direction but also its internal environment, fostering a workplace where people felt seen, heard, and empowered to grow.

This commitment to people was not just aspirational, it was measurable. miLife’s culture entropy scores, a globally recognised indicator of organisational health, steadily improved under his tenure: from 9% in 2019 to 6% in 2021, and just 5% in 2022. These low scores reflect a highly engaged, values-aligned workforce with minimal internal friction, all hallmarks of a thriving and purpose-driven organisation.

Through transparent communication, investment in staff development, and an open-door leadership style, Kwaku built more than a company; he built a culture where excellence, trust, and impact could flourish.

A Growing Footprint and Product Range Today

miLife touches the lives of over 1.3 million Ghanaians. In 2024 alone, the company paid out GHS 184 million in claims, fulfilling its promise when families needed it most.

miLife’s product suite now includes funeral, education, endowment, and income protection plans tailored for both individuals and groups. Flagship offerings like miTribute, miLegacy, miKids, and miFuture are accessible through an ever-expanding network of agents, bank branches, and digital platforms, ensuring that insurance is within reach for all, from the bustling cities to the remotest communities.

Purpose Beyond Profit

Kwaku also believed in giving back. Under his guidance, miLife’s corporate social responsibility efforts took on deeper meaning. The company became a proud supporter of child immunisation programmes in its host communities, helping protect the youngest and most vulnerable.

Since 2020, the company has distributed lesson notebooks, exercise books, footballs and football jerseys to over 650 schools across the country. From promoting financial literacy to supporting local schools and health outreach events, miLife under Kwaku became a business that didn’t just serve its customers but also served its country.

A Lasting Legacy

As Kwaku Yeboah-Asuamah steps down in May 2025, he leaves miLife not only bigger and stronger but also more respected, more trusted, and more human.

He leaves behind a company with deep roots and wide reach. A company that believes in innovation, inclusion, and integrity. A company is ready for the future because of the foundation he built.

Indeed, Kwaku did not just lead miLife, he transformed it. In doing so, he has left a lasting mark on Ghana’s insurance industry and on the lives of millions who now have the security and peace of mind that only insurance can bring.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.