On June 03, 2025, the Central Bank published a statement of the remarks made by Dr. Johnson Pandit Asiama, the governor of the Bank of Ghana, during the latter’s post-MPC meeting with CEOs of Banks. The statement emphasized five (5) key regulatory initiatives to be introduced very soon, according to the governor. Yieldera Policy Institute fully supports the governor’s call for greater transparency and market discipline. That notwithstanding, there are legitimate concerns regarding some aspects of the measures to restore credit discipline. We believe some do not go far enough, some seek to duplicate existing practices, and others, may send conflicting signals to the credit market.

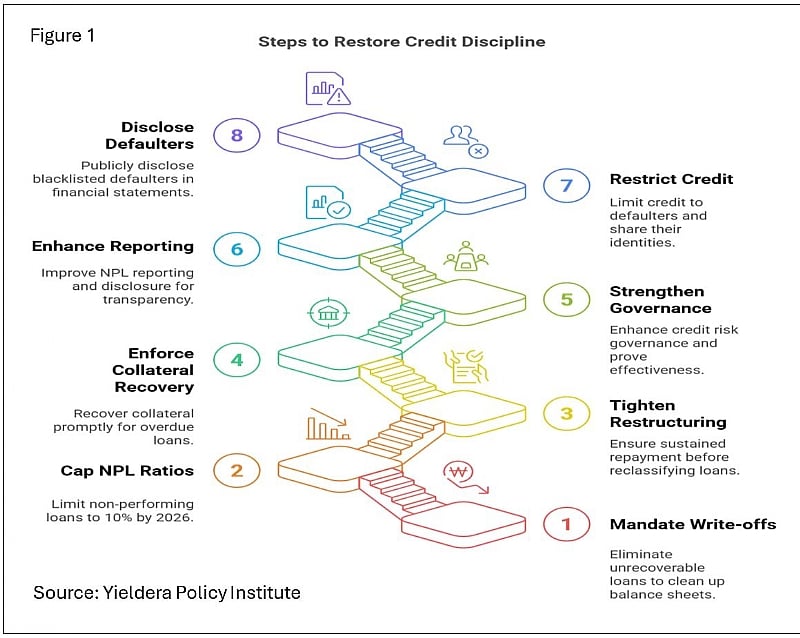

Figure 1 presents a graphical overview of the proposed measures to restore credit discipline.

In-depth Analysis

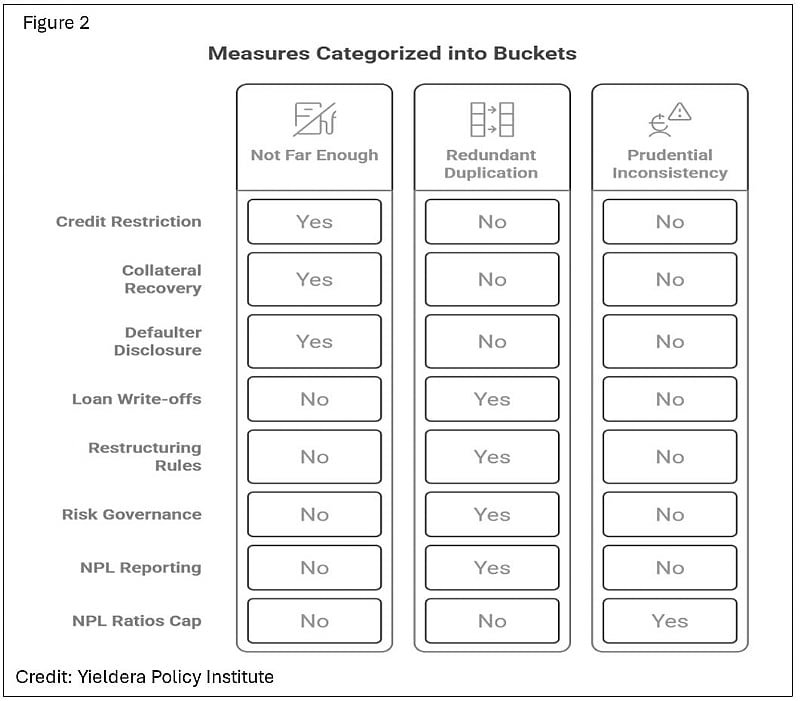

The measures, according to Bank of Ghana, forms part of a broader agenda to “restore asset quality, promote sound lending practices, and safeguard the resilience of Ghana’s financial system”. Whilst we agree with the policy intent, our view is that a nuanced assessment of the potential impact will better shape market expectations and conduct. For this reason, we employ an analytical framework that categorizes the proposed measures into three buckets:

Bucket 1: Measures that do not go far enough Bucket 2: Measures that appear to duplicate existing regulatory tools Bucket 3: Measures that send a confusing signal to the credit market.

Figure 2 presents a graphical overview of the 3 buckets.

Bucket 1. Measures that Do not Go Not Far Enough

1. Proposed Measure #1: Enforce timely collateral recovery, especially for overdue loans. Currently, the Borrowers and Lenders Act 2020, Act 1052, allows lenders to register security interest, and to file for Memorandum of No Objection (MONO) following credit default by the borrower. Whilst tinkering with process efficiency at the Collateral Registry may optimize outcomes, the benefit may pale in comparison to the enormity of problems that lenders face during collateral recovery. The laborious court system remains Pareto’s 20 percent in this scenario and a worthy target for policy intervention.

2. Proposed Measure #2: Disclose blacklisted wilful defaulters in audited financial statements, along with sectoral breakdowns of NPL exposures. Whilst this is useful, it’s important to recognize that few people actually read annual reports of banks and financial institutions. And let’s not forget, even publication of names of loan defaulters in print media such as the Daily Graphic, hasn’t deterred wilful defaults. We recommend that the directive should go further, and grant leave to lenders to publish the names and pictures of wilful loan defaulters (households and SMEs) on social media.

3. Proposed Measure #3: Restrict further credit to strategic or wilful defaulters and share their identities with key financial sector oversight bodies. Restricting credit to defaulters is a logical outcome of the delinquency management process. No sane lender will continue to lend to a wilful defaulter, so there is nothing here for policy intervention to address. Submitting returns to sector oversight bodies is where perhaps, policy and regulation can have most impact. Currently, pursuant to Section 26 of the Credit Reporting Act 2007, Act 729, institutions are mandated to submit credit data to licensed Credit Bureaus. Albeit compliance has improved over the years, operational inefficiencies continue to hamper growth. Instead of submitting data to 3 different bureaus, technology now makes it possible to harmonize the process by using a shared infrastructure. It is our humble view that separate credit reporting to an oversight body is wasteful duplication. Instead, we recommend that serious attention be given to addressing the existing constraint. An infrastructure that simplifies credit reporting to the Credit Bureaus, and allows for easy and democratic access by market participants would be a game changer.

4. Proposed Measure #4. Mandate write-offs of fully provisioned loans with no realistic recovery prospects, excluding related-party exposures. The prudential norm currently allows for write-offs subject to certain caveats. Particularly for NBFIs (Tier 2-4), this has been codified in Rule 45(5)) of the Business Rules and Sanctions for MFIs, 2017. Per the rule, except for related parties (which includes subsidiaries and affiliates) and connected persons (which includes directors, managers and staff plus relatives), write-offs must be done against loan loss provisions, subject to approval by the Bank of Ghana. It is unclear what the proposed measure would do differently. Rather than re-inventing the wheel, we recommend a strict enforcement of current rules instead.

5. Proposed Measure #5: Tighten restructuring rules, requiring sustained repayment before reclassification. This is a similar case. The prevailing portfolio management norms mandates that a delinquent credit facility or loan which has been re-negotiated or rescheduled shall continue to remain delinquent and be classified within the same quality grade. Re-classification is permitted after 12 months, and only after satisfactory repayment of the re-scheduled loan within the period. This is not a novel risk which merits new policy or regulatory intervention. Enforcing current regulatory standards will achieve similar outcomes.

6. Proposed Measure #6: Strengthen credit risk governance and require proof of effectiveness. Following the mass insolvency resolutions in 2017, the Central Bank has never been shy of issuing as many regulatory directives as possible. Not least of which are these two key ones; Corporate Governance Directive 2018, and the Capital Requirement Directive 2019. Between these two directives alone, there is sufficient regulatory material to hold boards and management teams of RFIs accountable for credit governance lapses. Except if there is a strong business case to outdoor a new, and perhaps more nuanced instrument, we recommend that resources be invested in strengthening the supervisory regime to drive effective monitoring. Anything less may lead to waste and duplication.

7. Proposed Measure #7: Enhance NPL reporting and disclosure, with monthly submissions and public transparency. It is not very clear what this mean, “enhance NPL reporting and disclosure”, particularly given that NPL is the most reported and most tracked prudential metric by all financial sector supervisory authorities across the globe. Perhaps the novelty relates to “public transparency”. And even that, there are concerns about the potential adverse impact on financial stability if NPL disclosures are not communicated intelligently and strategically. The current reporting framework (to supervisory authorities) is conducive to the task of detecting early signs of financial stress and the build of systemic risk. The benefits of increased public transparency should therefore be carefully weighed against the risks.

8. Proposed Measure #8: Cap NPL ratios at 10% of gross loans by December 2026. The current prudential benchmark for NPLs is 5%. Yet, the recent market performance hovers around 21 percent (on average). Why are credit portfolios struggling to remain below 5 percent? Because NPL is an output indicator. The predictive variables are quite complex and intertwined; risk management, corporate governance, business model, operating cost structure, etc. The point is this: if you want to achieve a certain outcome, don’t attempt to control that outcome, but rather focus on the inputs and the conversion process, and the outputs/outcomes may take care of itself. This view is not just philosophical but practical. The Central Bank will be better served if regulatory attention is focused on de-risking the input variables.

Yieldera Policy Institute is a think-tank focused on financial sector studies with a special lens on monetary policy, prudential regulation, systemic risk and financial stability. The author is a senior fellow at Yieldera Policy Institute.

By Nkunimdini Asante-Antwi (Senior Fellow, Yieldera Policy Institute)