In November 2022, global shocks pushed pump prices in Ghana to record highs. Diesel hit GH¢23 per litre and petrol GH¢17 at GOIL stations. The government blamed the Russia–Ukraine war, igniting a debate that continues to this day.

History may now be repeating itself, with blame shifting from Europe to the Middle East.

On Friday, June 14, Israel launched unprovoked airstrikes on Iran. The targets included senior military officials, nuclear sites, and missile infrastructure.

The assault follows nearly two decades of Israeli warnings over Iran’s uranium enrichment, which it says is central to a nuclear weapons programme.

Israel has long maintained it would not allow Iran to acquire that capability.

Iran insists its programme is peaceful and aimed at generating electricity. It says nuclear power will allow it to export more oil.

Israel claims Tehran is just months away from building a nuclear weapon and has acted accordingly.

Initial reports suggest the strikes killed top Iranian commanders and nuclear scientists.

Iran has since retaliated with missile launches into Israeli territory.

Oil Markets Panic. Ghana Braces

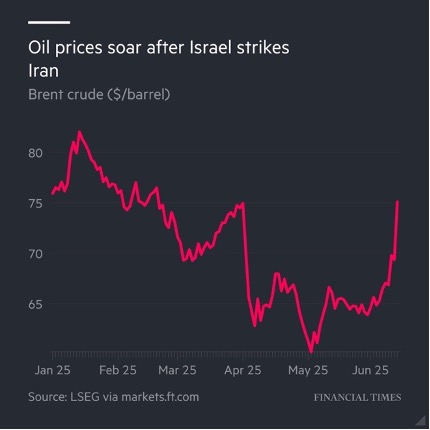

The escalation jolted oil markets. Brent crude rose more than 7% on Friday. That was the largest one-day gain since Russia’s invasion of Ukraine in 2022.

There is little sign of a quick resolution. Israel’s UN ambassador, Danny Danon, told Bloomberg the fighting could continue for weeks.

The economic fallout is already visible. Brent began the year at $74 a barrel, climbed to $81, then dropped to $60 by May. Over the same period, the cedi appreciated, supported by gold, cocoa and strong remittance inflows.

At the pumps, diesel and petrol are selling for under GH¢13 per litre in early June, down from GH¢16 in January.

Falling fuel costs had fed through to lower transport fares and food prices. Inflation fell to 18.4% in May, the lowest since February 2022.

But after the Israeli airstrikes, Crude prices quickly rebounded to $74 per barrel.

Iranian energy infrastructure is now also being targeted, and oil prices are expected to remain elevated as markets reopen. A further spike in price is possible if the fighting spreads.

The Middle East accounts for about 30% of global oil output, so any instability in the region risks disrupting supply.

One major risk is the Strait of Hormuz, a narrow shipping lane that handles about 25% of the world’s crude exports, mainly to Asia.

Saudi Arabia, Iran, Kuwait, the UAE, and Qatar all depend on the Strait to export crude.

Iran has often threatened to block the waterway, but has never done so. Bloomberg estimates a closure could push oil prices to $135 per barrel.

While the current surge is steep, the longer trend has been downward since late 2023. Brent peaked at $91 in September that year. OPEC oversupply and weak demand had kept prices soft, and unless the war escalates significantly, that trend could resume.

A shutdown of the Strait of Hormuz remains the most disruptive scenario, but it remains unlikely for now.

Fuel Levy Paused, Inflation Fears Grow

Nonetheless, oil prices are now returning to levels last seen in January 2025, when petrol and diesel were selling for nearly GH₵16 per litre at GOIL stations. The cedi, however, is significantly stronger now than it was then, but that may not be enough.

The Chamber of Oil Marketing Companies had projected a 9% increase at the pumps starting today. This was due to both the crude rebound and a proposed GH¢1 increase in the Energy Sector Levy.

But in response to escalating tensions in the Middle East, President Mahama instructed Energy Minister John Jinapor and Finance Minister Ato Forson to monitor developments closely and safeguard recent fuel price gains.

On Friday, the Energy and Finance Ministries, together with the Ghana Revenue Authority, officially postponed the levy’s implementation to shield consumers from further price shocks

The levy was expected to raise GH¢5.7 billion annually to buy light crude oil for thermal power. However, rising oil prices mean the same amount will now buy less.

Even if implemented, the levy is unlikely to fill the gap completely, especially if the conflict escalates further, further stressing the energy sector.

Gold Offers Some Cover — For Now

One source of relief is gold. On Friday, it rose to $3,432 per ounce. That is a daily increase of 1.37% and more than 30% up since January.

In global crises, investors usually flock to the US dollar and Treasuries. But with Donald Trump’s return stirring uncertainty, gold is outperforming. On Friday, both gold and the dollar rose. But gold gained more, signalling a shift in where investors feel safest.

The shift is not new. The European Union revealed that gold had overtaken the euro as the second most-held reserve asset by central banks in 2024, behind only the US dollar.

Ghana benefits directly. Higher gold prices boost export earnings and improve dollar inflows, which support the cedi.

Even so, the support is gradual. The cedi weakened slightly on Friday, slipping from GH¢10.25 to GH₵10.35 per dollar as oil shocks hit faster than gold flows.

If prices remain high, the Bank of Ghana may need to supply more dollars to Bulk Oil Distributors (BDCs). That would put pressure on foreign reserves.

If gold production and inflows remain strong, the situation should remain slightly manageable.

The Comeback of Inflation?

Delaying the fuel levy offers short-term relief but leaves a GH¢2.9 billion revenue gap for the second half of the year.

If the conflict escalates, especially if Iran blocks the Strait of Hormuz, oil prices could rise sharply. That would place Ghana’s fragile recovery at risk.

Inflation, now at a two-year low, may reverse course as fuel prices touch every part of the economy. Higher transport and input costs could drive up the price of food and utilities.

Many analysts had expected the PURC to announce a reduction in utility tariffs during its next quarterly review. This was based on the stronger cedi and falling crude prices recorded in May. That now appears unlikely.

A drawn-out conflict could lead to higher electricity and water bills, adding further pressure on households and inflation.

Rising fuel and food prices would also make it harder for the Bank of Ghana to meet its year-end inflation target of 11.9%.

Gold provides some cushion. Higher prices are boosting export earnings and helping to stabilise the cedi. But that support is limited if oil prices remain elevated.

Crude costs filter into nearly every import, from fertilisers and machinery to shipping and logistics. The result is higher prices across multiple sectors, even with strong gold inflows.

The vulnerability is partly self-inflicted as Ghana missed the opportunity to rebuild strategic oil reserves when crude was cheap. With no oil refinery running optimally, the country remains exposed unless structural fixes are made.

Oil export revenues may improve as a result of higher crude prices, but output has declined for five consecutive years. It remains unclear whether any windfall will be large enough to cover energy sector needs or generate enough foreign exchange to defend the currency.

Ghana cannot afford another oil shock like the one in 2022. What happens in the Middle East and how the government responds will shape the rest of 2025.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.