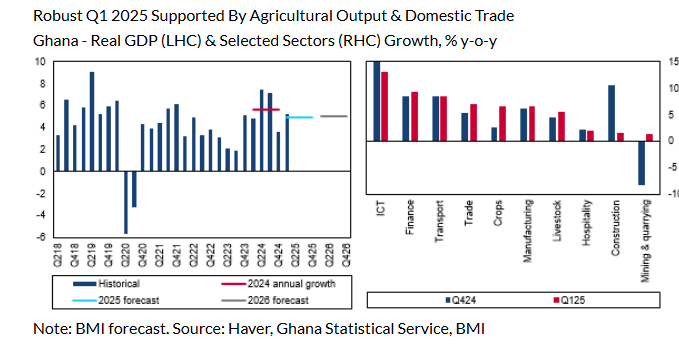

Fitch Solutions has revised Ghana’s 2025 real economic growth forecast from 4.2% to 4.9%.

This follows what it described as a stronger-than-anticipated quarter one 2025 results.

Data released by the Ghana Statistical Service on June 6, 2025, showed that real GDP growth accelerated from 3.6% year-on-year in quarter 4, 2024, to 5.3% in quarter 1, 2025, surpassing Fitch Solutions’ expectation that growth would have remained around the 3.5% mark.

“The Q1 growth spurt was primarily driven by stronger agricultural output, particularly in crop production and fishing. The mining & quarrying sector also performed better than in the previous quarter, despite continued weakness in the hydrocarbons sector, pointing to growing momentum in gold extraction amid elevated prices. In addition, faster growth in domestic trade also supported headline economic growth, indicating improving consumer activity across the economy”, the UK-based firm said.

Consumer Spending to Continue to Drive Growth

It continued that consumer spending will continue to drive growth over the remainder of the year as a stronger cedi pushes down inflation.

The price of gold—already high due to geopolitical tensions and central bank purchases—has increased further due to uncertainty around US President Donald Trump’s trade policies.

“Indeed, our Metals & Mining team forecasts that gold prices will average a record US$3,100 per ounce this year, 29.7% higher than in 2024. As Africa’s largest gold producer, historically high gold prices have already boosted Ghana’s international reserves to near-record levels of US$7.9 billion as of April [2025]”, it mentioned.

“This has led to a significant appreciation of the Ghanaian cedi, which strengthened by approximately 50% against the US dollar over April-May, emerging as the world’s best-performing currency in the year to date”, it added.

It alluded that Ghana’s position as a net importer of essential consumer goods—including petrol, vehicles, rice, and pharmaceuticals—means the stronger exchange rate will help to reduce inflation in the coming months.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.