Republic Bank Ghana PLC has posted impressive financial results for the year 2024, recording a total profit of GH₵210.67 million, a significant 45% increase from the GH₵145.03 million recorded in 2023.

This growth has been primarily driven by higher net interest income and a decline in impairment losses on financial assets, underscoring the bank’s improving operational efficiency.

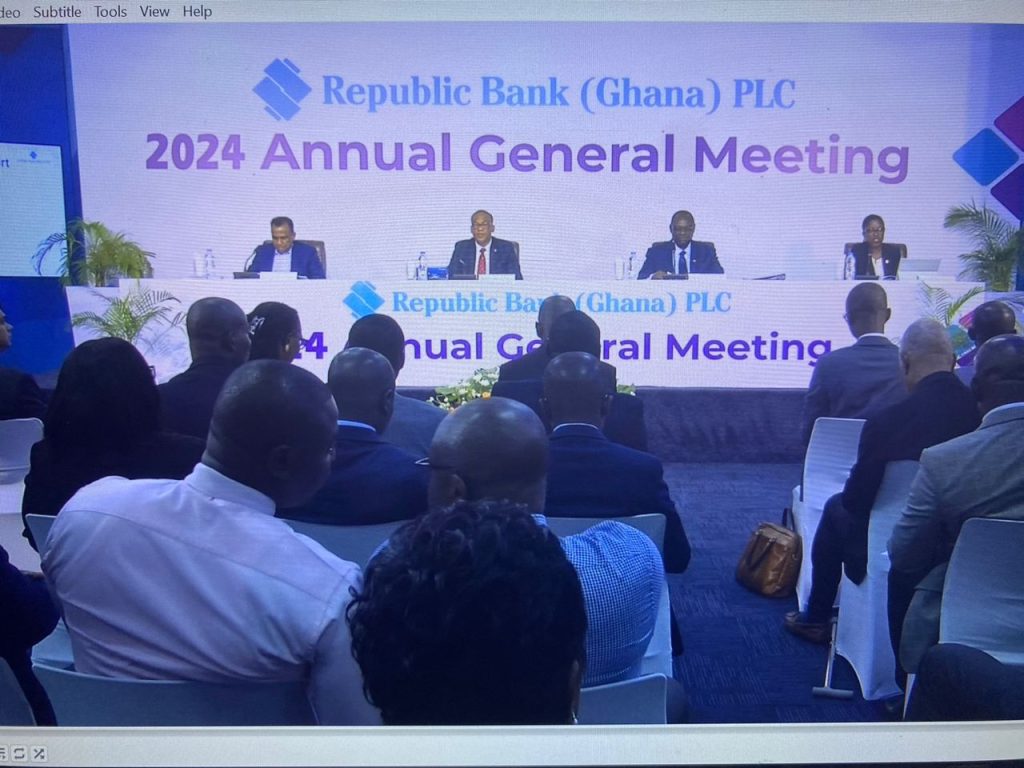

At the bank’s Annual General Meeting, Managing Director Dr. Benjamin Dzoboku said the performance of the bank is due to new ideas to serve its customers.

He noted that the bank had strategic moves approved by the Board of Directors to improve its financial position.

“We have seen that the first quarter results, we have a credit over GH₵30 million. The expectation is that by the end of December, we should have over GH₵200 million in the retained earnings that will help us to pay dividends in 2026”, he assured.

Republic Bank’s profit before tax surged to GH₵329.04 million in 2024, reflecting strong profitability.

The bank’s total assets also expanded by 42.4%, reaching GH₵367.2 billion, while total deposits grew by 38.7% to GH₵277.3 billion.

Republic bank Ghana PLC also saw its loans and advances increase by 28.7% to over GH₵94.6 billion, outpacing the 22% growth recorded in 2023.

Notably, the bank succeeded in reducing its non-performing loans (NPL) ratio from 15.87% in 2023 to 15.66% in 2024, signaling improved credit risk management.

Republic Bank Ghana PLC says it remains optimistic about the future, targeting continued revenue growth and improved asset quality.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.