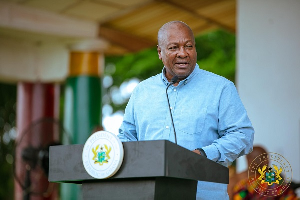

John Dramani Mahama is the President of Ghana

John Dramani Mahama is the President of Ghana

The 24H+ economic policy is an Integrated Approach. It links Agriculture for Sovereignty and Sustainability (Grow24), Manufacturing Ghana’s Industrial Future (Make24), Infrastructure for Integrated Growth (Build24), Culture, Creativity, and Tourism for National Identity and Jobs (Show24), Supply Chain and Market System Efficiency (Connect24), Capital for Inclusive and Strategic Investment (FUND24), Workforce Development and Cultural Re-orientation (ASPIRE24), and Civic Engagement and Government Alignment (GO24).

This revised 24-hour+ economy policy, an update from the earlier document captured in the NDC manifesto, is commendable. In fact, it resembles a comprehensive national policy for the country. The revised policy seeks to address and move our economy away from fragmented sectoral interventions (e.g., agriculture alone, industry alone) toward a whole-economy transformation through interconnected systems (the 24H+ Integrated Approach). The rationale behind this shift is resilience. A sectoral approach is vulnerable to shocks, for instance, a global rise in input prices can halt progress in a single sector. Moving away from this siloed approach is about systemic resilience: aligning local inputs, logistics, finance, and skills to sustain production.

However, Prof. Isaac Boadi, the Dean of the Faculty of Accounting and Finance at UPSA and Executive Director of the Institute of Economic and Research Policy (IERPP), raises critical questions about the fragility of interdependencies. For example, a failure in one node (e.g., energy) could cascade across sectors. Prof. Boadi also questions the sustainability of the program, particularly if the models or tracks in Pillar 6 (FUND24) are not carefully considered.

The 24H+ economy has been presented as a bold paradigm shift, an integrated policy designed to drive productivity and inclusive growth through continuous economic activity. However, its financial anchor, FUND24, reveals critical structural weaknesses that undermine this grand vision. Tasked with mobilizing $4 billion for SMEs, infrastructure, and job creation, FUND24’s reliance on Development Bank Ghana (DBG) borrowing in foreign currency and lending in local cedis exposes the entire framework to severe exchange rate vulnerabilities. In a country where the cedi depreciated by 40% in 2022, such a model risks triggering systemic defaults and financial instability.

Moreover, the proposal to deploy GHS 42 billion in pension funds into high-risk SME equity financing raises profound concerns about fiduciary responsibility and intergenerational equity. Pension funds are not venture capital; they exist to safeguard the livelihoods of retirees, not to underwrite fragile startups in an uncertain macroeconomic environment.

Compounding these flaws is the digital finance assumption. FUND24’s strategy rests on a digital infrastructure that excludes nearly half the population, making its promise of financial inclusion appear more aspirational than practical.

In its current form, FUND24 is conceptually ambitious but economically reckless. Without structural reforms, particularly in currency risk management, pension fund governance, and digital accessibility, it threatens to become yet another unfulfilled promise in Ghana’s economic playbook. A truly transformative policy demands realism, not rhetorical ambition.

Author:

Prof Isaac Boadi

Dean, Faculty of Accounting and Finance, UPSA

Executive Director, Institute of Economic and Research Policy (IERPP)