Introduction

Exchange rate movements are a critical pillar of macroeconomic stability in Ghana. Historically, the Ghana cedi has faced persistent depreciation due to factors such as chronic trade deficits, fiscal imbalances, inflationary pressures, and adverse global economic conditions. For example, the cedi lost nearly 24% of its value in 2024, making it the fourth-weakest currency in West Africa that year, according to the World Bank Africa Pulse Report (April 2025).

However, 2025 has witnessed a remarkable turnaround. The cedi became the best-performing currency in the world in Q2 2025, appreciating by approximately 30–40% between April and June 2025, rebounding from a low of GHS 15.56/USD in early April to around GHS 10.28/USD by June (Reuters, 2025, S&P Global, June 2025).

Understanding the drivers behind this strengthening of the cedi and its broader macroeconomic implications is essential for businesses, financial institutions, policymakers, and households. While a stronger cedi can reduce the cost of imports, ease inflation (which fell to 18.4% in May 2025, its lowest since 2021), and improve real incomes, it can also:

Erode export competitiveness, Lower remittance value in local terms, And affect bank balance sheets, especially those exposed to foreign currency positions.

This article provides a comprehensive examination of the cedi’s recent appreciation trend. It analyzes the underlying drivers, highlights sector-specific impacts, and outlines key policy recommendations to ensure stakeholders respond effectively and sustainably in a rapidly evolving currency environment.

Exchange Rate Trends in Ghana

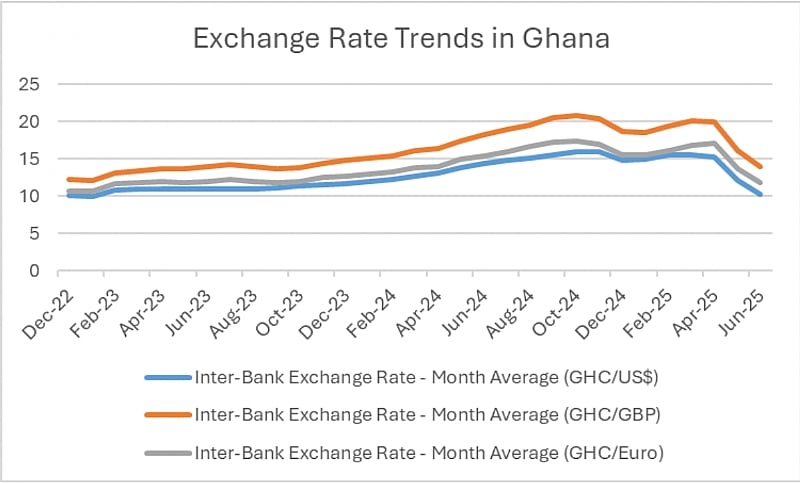

Exchange rate movements remain a critical indicator of Ghana’s macroeconomic stability, influencing inflation, external trade, and investment behaviour. Between December 2022 and June 2025, the Ghana cedi experienced significant volatility against the US dollar, British pound sterling, and the euro, reflecting both external shocks and internal policy responses.

At the close of 2022, the cedi showed signs of stabilization following a turbulent fourth quarter. The official interbank exchange rates averaged GHS 10.03 to the US dollar, GHS 12.24 to the pound, and GHS 10.62 to the euro in December 2022. These figures represented modest appreciation compared to the preceding months, largely supported by Bank of Ghana interventions and a seasonal improvement in foreign exchange supply.

In early 2023, the cedi posted further gains. By January, the currency appreciated slightly to GHS 9.91 per USD, while remaining steady at GHS 12.13 per GBP and GHS 10.70 per EUR. However, this trend reversed gradually from February onward. Throughout 2023 and into early 2024, the cedi faced renewed pressures, driven by delays in donor inflows, higher import demand, and global monetary tightening. By March 2024, interbank rates had depreciated to approximately GHS 12.67 per USD, GHS 16.11 per GBP, and GHS 13.78 per EUR.

The most significant period of cedi depreciation occurred between April and October 2024. During this phase, the exchange rate peaked at GHS 15.99 to the dollar, GHS 20.86 to the pound, and GHS 17.42 to the euro, highlighting the intensity of pressure across all three major currencies. The steepest losses were observed against the pound, reflecting its strength relative to the dollar and euro, as well as Ghana’s trade and remittance exposure to the UK.

Signs of recovery began to emerge in November 2024. By December, the cedi had appreciated modestly to GHS 14.78 per USD, GHS 18.69 per GBP, and GHS 15.47 per EUR. This recovery accelerated in the first half of 2025, especially in the second quarter. Between April and June, the cedi strengthened rapidly, falling from GHS 15.22 to 10.28 against the dollar, and from GHS 19.98 to 13.96 against the pound. A similar trend was observed against the euro, with the rate appreciating from GHS 17.09 to 11.86 over the same period.

These fluctuations illustrate the cedi’s sensitivity to both domestic and external conditions. A comparative view of monthly exchange rate movements across the three currencies is provided in Figure 1, highlighting the alternating periods of depreciation and appreciation over the 31 months.

Figure 1: Exchange Rate Trends in Ghana

Source: https://www.bog.gov.gh/economic-data/exchange-rate/

Comparative Regional Currency Performance vs. USD

🇬🇭 Ghanaian Cedi (GHS)

In 2025, the cedi has experienced a remarkable rebound, appreciating by roughly 40–50% against the USD since early in the year—making it one of the world’s best-performing currencies (reuters.com, thevoiceofafrica.com). However, as per a World Bank report, it has also weakened by about 4% year-to-date in 2025—likely a temporary correction following earlier sharp gains.

🇰🇪 Kenyan Shilling (KES)

The KES appreciated approximately 20% in 2024, and has remained stable in early 2025, trading within the KSh128–129 range per USD (myjoyonline.com). Recently, it’s quoted around 129.00–129.50 per dollar, supported by steady export inflows (reuters.com).

🇳🇬 Nigerian Naira (NGN)

The NGN has seen modest gains more recently: officially around ₦1,525/USD, with street rates near ₦1,567/USD, and the trend moving toward ₦1,500/USD facilitated by central bank support (reuters.com).

🇺🇬 Ugandan Shilling (UGX)

The UGX has strengthened slightly, trading between 3,582–3,592 per USD, buoyed by remittance and export inflows (reuters.com).

Table 1: Summary Table: Year-To-Date (YTD) Currency Performance (2025)

Currency Approx. Mid-2025 Rate YTD Performance/Trend GHS ~$10–11 per USD +40–50% ↑ (but –4% correction) KES ~KSh128–129 per USD +20% in 2024; stable in 2025 NGN ~₦1,525 (official) / ₦1,567 (street) Slight recovery, trending to ₦1,500 UGX ~₳3,582–3,592 per USD Modest gains over past week

Key Takeaways

Ghana’s cedi has outperformed both the Kenyan shilling and Nigerian naira, ranking among Africa’s strongest performers in early to mid‑2025 (thevoiceofafrica.com, gbcghanaonline.com, businessday.ng, reuters.com). The Kenyan shilling remains broad stable, benefiting from strong exports and remittances . The naira is gradually recovering from prior weakness, supported by central bank interventions (reuters.com). The Ugandan shilling shows steady, moderate gains thanks to remittance and export inflows (reuters.com).

Broader Context

World Bank’s Africa Pulse notes that the cedi’s current performance—after 2024 depreciation—makes it one of the best in Africa so far in 2025 .

Reuters coverage confirms the cedi’s “best-performing currency in 2025” status, outpacing peers (thevoiceofafrica.com

Drivers of Cedi Appreciation

The Ghana cedi saw significant appreciation during certain stretches between late 2022 and mid-2025. This reversal was supported by tight monetary policy, robust Foreign Exchange (FX) inflows, and improved external conditions, which together helped stabilize the exchange rate.

Monetary Policy Tightening

A key domestic driver of cedi appreciation was the Bank of Ghana’s sustained monetary policy tightening. In response to elevated inflation and currency volatility, the central bank raised the Monetary Policy Rate (MPR) multiple times throughout 2022 and 2023, making cedi-denominated assets more attractive to investors and helping to moderate foreign exchange demand.

By March 2025, the Bank of Ghana increased the MPR by a further 100 basis points, maintaining it at 28.0% into early 2025 to anchor inflation expectations and support the currency (spglobal.com) . With inflation hovering around 21–23% during this period, real interest rates rose to between 5% and 7%, offering positive returns to investors and encouraging capital inflows into local assets. These higher real yields contributed significantly to cedi stabilisation by dampening speculation and reinforcing investor confidence.

Central Bank Interventions

In addition to monetary tightening, the Bank of Ghana implemented a range of direct market interventions to improve foreign exchange liquidity and stabilise the cedi. These included regular FX auctions to commercial banks and other institutions, increased forex supply from strategic programmes such as gold-for-oil and cocoa export-backed inflows, and enhanced regulatory oversight of forex bureaux and unlicensed money transfer operators.

These interventions were particularly effective during key appreciation periods—in late 2022 and again in early 2025—when market pressures were elevated. The central bank’s consistent interbank FX auctions, along with stricter enforcement of compliance rules for bureaux de change and remittance operators, helped reduce parallel market distortions and increased confidence in the formal FX system.

Supported by the inflows from gold-for-oil and cocoa exports, these measures proved instrumental in restoring exchange rate stability. By May–June 2025, the cedi appreciated sharply to trade around GHS 10.28–10.31 per USD, recovering from a low of approximately GHS 15.50 in April (modernghana.com)

Improved Export Earnings and Seasonal Inflows

Episodes of cedi appreciation also aligned with stronger export performance and seasonal inflows of foreign exchange. Notably, Ghana recorded increased earnings from cocoa, gold, and oil, with cocoa export receipts in the fourth quarter of 2024 providing a critical boost to FX liquidity. These flows supported the cedi’s rebound at a time of significant external pressure.

In parallel, remittance inflows, particularly during festive periods and academic terms, played a stabilising role by enhancing foreign exchange availability in the retail and interbank markets.

These inflow pulses had a tangible impact on the currency’s recovery. By April 2025, the cedi rebounded from its earlier low of approximately GHS 15.56 per USD, appreciating to a range of GHS 11.70–12.80 by late May. Overall, the cedi appreciated by roughly 14.7% between January 2025 (∼GHS 15) and May 2025 (∼GHS 12.8), underscoring the significance of export-driven and seasonal FX inflows in restoring currency strength.

Debt Restructuring and External Financing

Progress under Ghana’s debt restructuring framework—particularly in collaboration with the International Monetary Fund (IMF)—played a critical role in restoring macroeconomic stability and supporting the cedi. The Extended Credit Facility (ECF) programme, approved in May 2023 with a total value of USD 3 billion, led to phased disbursements throughout 2024 and 2025. These disbursements boosted Ghana’s gross international reserves from USD 5.92 billion in 2023 to approximately USD 8.98 billion in 2025, representing close to four months of import cover. (worldbank.org)

This financing, alongside World Bank budget support and contributions from other multilateral partners, replenished foreign exchange buffers and alleviated pressure on the currency market. The improved reserve position contributed to greater investor confidence and supported the cedi’s stability during periods of external vulnerability.

Market Sentiment and Policy Credibility

A final key driver of cedi appreciation was the renewed market confidence stemming from improved policy coordination, transparent communication, and fiscal discipline. The Bank of Ghana’s enhanced communication strategy, in conjunction with the Ministry of Finance’s fiscal consolidation efforts, played a crucial role in anchoring expectations around macroeconomic stability.

Confidence was further reinforced by reforms implemented under the IMF’s Extended Credit Facility (ECF), ongoing budget rationalisation, and visible efforts to reduce public sector borrowing. These actions helped to signal improved governance, policy discipline, and commitment to debt sustainability.

As a result, inflation declined significantly, falling from 37.2% in late 2022 to 18.4% by May 2025, the lowest in over three years (spglobal.com). With declining inflation and reduced exchange rate volatility, speculative dollarisation also eased. More transactions returned to the formal foreign exchange market, increasing official FX liquidity and supporting exchange rate stability.

These confidence-driven dynamics were central to cedi appreciation episodes observed in:

• Late 2022, following stabilisation efforts

• Late 2024, after peak depreciation

• April to June 2025, during the most significant recovery phase.

In summary, tight monetary policy (28%), central bank FX interventions, robust export and external financing inflows, and improved policy credibility together reversed the cedi’s depreciation cycle. From April to June 2025, the currency appreciated ~33%, reaching its strongest position in years as shown in Table 2.

Table 2: Key Appreciation Episodes

Period Key Exchange Rate Movement Late 2022 Rebounded from ~GHS 13.1 (Nov) to ~GHS 8.58 (Dec) Late 2024 Extension from ~GHS 16.3 (Oct 2024) to ~GHS 14.7 (Dec 2024) Q2 2025 (Apr–Jun) Strongest surge: from ~GHS 15.5 (Apr) to ~GHS 10.3 (Jun) — ~33% gain

Implications of Cedi Appreciation

The recent appreciation of the Ghanaian cedi—particularly between April and June 2025—has had far-reaching implications for various segments of the economy. While the stronger currency has brought relief in the form of lower inflation, reduced input costs, and enhanced macroeconomic stability, it has also introduced significant challenges for export-oriented sectors, banks, and remittance-dependent households.

This section analyses the impact of cedi appreciation across three broad dimensions:

Banks and financial institutions (Section 5.1), Individuals and households (Section 5.2), and The wider economic context (Section 5.3).

It highlights how stakeholders are responding to the appreciation cycle, the trade-offs they face, and the structural adjustments required to ensure that the macroeconomic gains are broadly shared and sustainable

Implications for Banks and Financial Institutions

Banks play a dual role in the foreign exchange market, serving as both participants and facilitators. Exchange rate movements affect their balance sheets, product pricing, and customer behaviour.

Foreign Currency Deposits and Loans

• FX deposits decline in local value: As the cedi strengthens (e.g., from GHS 15.56 to GHS 12.89 in April–May 2025—a 16.9% gain) (thebftonline.com, gna.org.gh), the GHS equivalent value of USD/EUR deposits drops, diminishing the appeal of FX accounts.

• Loan demand shrinks: With borrowers expecting continued appreciation, demand for USD loans wanes. However, existing borrowers benefit—repayment costs in cedi terms fall, reducing default risk on foreign-denominated loans.

Net Open Position and Risk Management

• Appreciation directly alters banks’ Net Open Positions (NOP). Institutions with FX-denominated assets or liabilities must recalibrate hedging strategies to mitigate valuation mismatches.

• According to BFT, while banks gain from improved borrower creditworthiness, holdings of foreign currency assets lose local value, increasing exposure for institutions with FX-heavy portfolios (thebftonline.com).

Income and Product Pricing

• With appreciation, interest income from FX loans declines in real cedi terms.

• FX products like forwards and trade finance must be repriced to remain competitive.

• These dynamics may compress FX-related margins and necessitate adjustments in product mix and pricing strategy.

Implications for Individuals and Households

a. Purchasers of Imported Goods and Services

• Stronger cedi leads to cheaper imports, benefiting consumers and businesses reliant on imported inputs.

• The cost of overseas education, medical care, and travel declines—enhancing disposable income and consumer welfare.

b. Remittance Recipients

• Interestingly, appreciation reduces the GHS value of remittances.

• Households receiving USD/GBP/EUR see less local purchasing power, which could adversely affect living standards and savings—particularly among lower-income families.

c. Dollarised Savings and Investments

• Appreciation may discourage holding USD savings, as they lose local value.

• Investments and pensions denominated in foreign currencies may experience paper losses.

• Conversely, a strong cedi may foster confidence in domestic assets and reduce the demand for hedged instruments.

Overall, the appreciation of the cedi offers important inflation control benefits but must be managed carefully to avoid unintended negative effects on export competitiveness, bank balance sheets, and household income. The impacts of cedi appreciation on stakeholder groups have been summarized in Table 3.

Table 3: Impacts of Cedi Appreciation on Stakeholder Groups

Stakeholder Benefit (✓) Risk Importers ✓ Lower input costs — Exporters — Reduced competitiveness SMEs ✓ Lower import prices Increased competition Banks ✓ Lower loan defaults FX margin compression Consumers ✓ Cheaper goods/travel Remittance losses

Source: Author’s synthesis based on exchange rate behaviour and sectoral responses

Table 3 summarises the differentiated impacts of cedi appreciation across major stakeholder groups in Ghana’s economy. While importers, consumers, and banks tend to benefit from a stronger currency—primarily through reduced input costs, cheaper goods and services, and lower default risk—other groups, such as exporters and remittance-receiving households, face downside risks. Exporters experience reduced competitiveness due to lower cedi-equivalent revenue, while households may see a decline in the local value of foreign transfers. SMEs often straddle both sides of this divide, benefiting from lower costs but facing increased competition from cheaper imported alternatives. For financial institutions, appreciation presents both opportunities and risks, particularly around product pricing, net open positions, and customer FX behaviour.

The diagram highlights the dual nature of appreciation: while it supports price stability and cost control, it can also undermine foreign income flows and export performance, requiring careful policy balancing.

Wider Economic Context Between April and June 2025, the cedi appreciated by approximately 30% against the USD (thebftonline.com, spglobal.com), helping to reduce inflation and lower input costs for business. Banks have benefited from improved borrower health—lower provisioning requirements—but face pressure on FX margins and NOP management (thebftonline.com). Policy and market factors combine: with inflation moderating and FX volatility reduced, regulators must also safeguard vulnerable sectors (e.g., exporters and remittance-dependent households).

Policy Implications

Support banks’ risk management: BoG to issue updated FX risk guidelines and conduct stress tests that include appreciation scenarios. Promote use of local FX derivatives to manage exposures. . Protect remittance inflows: Encourage competitive remittance platforms and linked savings or investment products to offset losses from currency movements. Balance banking incentives: Ensure that capital adequacy frameworks take into account changes in Net Open Positions (NOPs), and promote efficient liquidity planning through currency-specific Cash Reserve Requirements (CRRs) (thebftonline.com, linkedin.com, bog.gov.gh). Export competitiveness shield: Support exporters via targeted hedging, subsidies, or pricing tools to offset cedi strength impacts.

Conclusion

Cedi appreciation offers both opportunities and challenges. While it reduces the cost of imports and external debt, it also threatens foreign income flows and price competitiveness for exporters. Ghana’s monetary authorities must continue to balance inflation control with structural support for productive sectors. Strengthening market confidence, improving trade infrastructure, and maintaining policy credibility will be key to ensuring that exchange rate stability benefits all stakeholders in a sustainable way.

By National Banking College