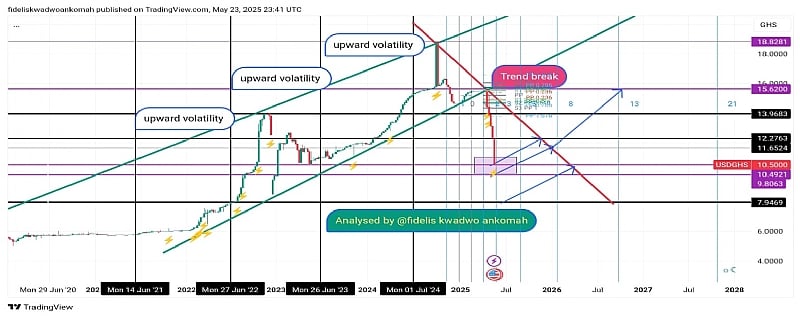

The Ghanaian Cedi’s exchange performance against the US Dollar has undergone significant volatility over the past three years(2022-2025). A technical analysis of the USD/GHS exchange rate reveals critical insights into the currency’s behaviour, potential support and resistance levels, and market sentiment shaping future movements, the opportunities, and the risks.

Key Phases of the USD/GHS Exchange Rate Trend

– Upward Volatility and Bullish Channel (2021–2024):

From mid-2021 through 2024, the USD/GHS pair followed a sharp upward trajectory, exhibiting persistent bullish momentum within a clearly defined ascending channel. Notably, three distinct waves of “upward volatility” were observed, each fueled by macroeconomic imbalances, FX supply shocks, and inflationary pressures in Ghana.

– Trend Break and Structural Shift (2025):

The major “Trend Break” captured in early 2025 signifies a structural reversal. This breakaway from the upward channel suggests a shift in market dynamics, likely triggered by improving FX inflows (e.g., cocoa exports, IMF disbursements, and an increase in the price of gold and its export), gradual easing in monetary policy, among others. The current USD/GHS exchange trend indicates aggressive bearish momentum. At the close of the market on Friday, 23rd May 2025, the price closed at exactly GHS10.50 per 1USD based on data from Tradingview.com.

– Support and Fibonacci Zones:

The current price consolidation zones between GHS 10.50 and GHS 9.80 align with historical Fibonacci retracement levels (0.236 and 0.382), suggesting possible medium-term support. If breached, the next downside target lies at GHS 7.94. Conversely, the GHS 13.96 and GHS 15.62 zones are key resistances for any bullish recovery attempts. Beyond these key levels, price can extend to 18.82 before a new higher-high can be formed. This shows that the Cedi has adequately strengthened and if managed properly, it can take considerable amount of time to break key support zones like 15.62.

Forward Outlook (2025–2027)

The projected price action marks potential retracement or consolidation over the next 12–24 months, with blue upward and downward arrows signaling probable reaccumulation or deeper correction phases. Key timing intervals (13, 21 months) hint at Gann cycle projections or harmonics, suggesting reversal or breakout opportunities.

Strategic Implications

For policymakers: The current break in trend offers a window to consolidate macroeconomic gains and stabilize the Cedi sustainably. For businesses: This signals reduced FX cost pressure in the short term, allowing better import planning and hedging strategies. For investors: Watch for confirmation of support around GHS 10.50. A rebound from here could offer short-term trading opportunities, but sustained bullish structure needs to reclaim above GHS 13.96 For businesses exposed to currency risk, they should consider hedging strategies such as forward contracts and currency swaps where available. Also, they should consider localizing supply chains and reduce dollar-denominated liabilities to minimize FX exposures in this era of high volatility. Businesses owing externally can take advantage of the Cedi appreciation to settle their debt.

Macro-Level Opportunities

Investor Confidence: The trend break creates a favorable outlook for foreign direct investme as it improves market confidence and positive investor sentiment. Stability is like to attract new investors into the economy which is likely to have a long-term effect the economy and the entire fiscal space.

Policy Credibility: Consistent FX performance enhances the credibility of the central bank and government, providing fiscal space for social investment. This will be a positive signal to Ghana’s external partners that the Ghanaian economy had rebound which in the long-run can improve the credit risk profile of the country. Also, Ghana’s debt service ratios would eventually be improved to create room for access to external financing facilities.

To sustain this trajectory, citizens should avoid speculative dollar purchases that create artificial demand pressures. Using the cedi for major transactions strengthens demand and circulation for the local currency. Additionally, increased public education on inflation, savings, and currency markets can promote responsible spending and investment behaviour. A financially literate population is less prone to panic-induced conversions and the believe that the best way store value is to invest in foreign currencies.

The break from historical USD/GHS upward volatility represents a watershed moment. It offers both relief and responsibility, a chance for Ghana to rebuild macroeconomic resilience, empower local businesses, and reduce its exposure to global currency cycles. However, the sustainability of this trajectory depends not just on central government policies, but on collective action from businesses, citizens, and financial institutions. To fully capitalize on this potential turning point, Ghana must strengthen coordination between monetary, fiscal, and trade policies, while fostering a culture of economic discipline at all levels.

Reference

USD/GHS Live Chart, Tradingview.com: assessed on 23/05/2025