In today’s dynamic economic environment, financial reporting quality has shifted from a narrow technical concern to a key pillar of national development. Ghana has witnessed multiple corporate failures directly tied to weak governance structures. The 2017–2019 banking sector cleanup exposed serious lapses in board oversight and financial reporting, leading to license revocations and public outrage. In the private sector, delayed or restated financial statements have eroded shareholder value and weakened public trust.

These failures are not isolated. Poor governance erodes trust in capital markets, deters investment, and increases regulatory burdens. Recent empirical evidence offers a clear path forward: enhance audit committee independence and competence, and promote genuine gender diversity on boards. These are not cosmetic fixes or box-ticking exercises; they are strategic levers for accountability, transparency, and long-term resilience.

To improve governance, Ghanaian firms must prioritise appointing financially literate, independent directors with strong oversight powers. Boards should embed ongoing training in financial reporting, risk management, and ethics. Regulators like the SEC and GSE must also enforce stricter, more meaningful disclosure standards on board composition, audit committee roles, and governance practices. As Ghana seeks to attract more foreign capital and deepen local investor participation, these reforms must become part of corporate culture rather than mere formalities. In today’s global economy, where transparency drives value, sound governance is not optional but a competitive necessity

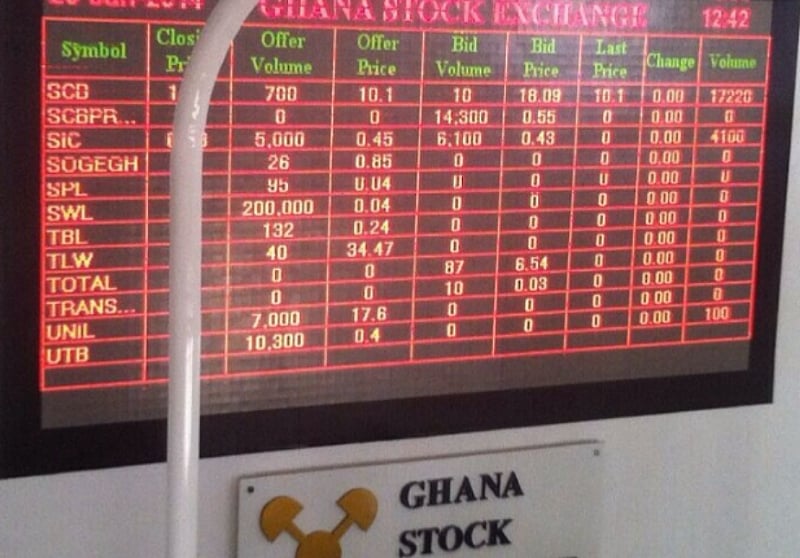

This study explores how board structure and ownership concentration affect the value of companies listed on the Ghana Stock Exchange. It focuses on board size, independence, female representation, audit committee activity, and whether dominant shareholders influence firm performance. Using data from Ghanaian companies, the study shows which governance practices promote firm value and which may hinder it. The aim is to provide practical insights for businesses and regulators. Strengthening governance in Ghana can boost investor confidence and enhance capital market credibility.

This study is significant because it offers real evidence from Ghana on what effective corporate governance looks like and how it impacts a company’s market value. While many governance codes follow global standards, Ghanaian firms face distinct economic, regulatory, and cultural challenges. By focusing on local data, this research helps business leaders and regulators identify which board practices genuinely drive performance. It shows that enhancing board independence, increasing gender diversity, and managing ownership concentration can improve a firm’s value and investor trust.

As Ghana works to attract investment and rebuild trust in its financial markets, studies like this provide a roadmap for building stronger, more accountable companies.

Theoretically, scholars support good governance through frameworks like agency theory, stakeholder theory, and resource dependence theory. Agency theory highlights the conflict between shareholders and management, stressing the need for mechanisms such as independent audit committees to ensure oversight and accountability.

Stakeholder theory broadens the board’s role to include employees, regulators, customers, and the wider community. Here, ethical and transparent reporting is not just a legal requirement but a moral obligation that fosters long-term trust.

According to resource dependence theory, board diversity, especially in gender and expertise, equips firms to handle external challenges, tap critical knowledge, and make sound decisions.

Diverse boards can better manage risk, meet stakeholder expectations, and maintain reporting integrity. Together, these theories highlight that board composition, audit committee competence, and diversity are fundamental to corporate accountability, reputation management, and sustainable

The findings of the study are both revealing and timely:

Independent audit committee meetings strengthen oversight. Active and engaged committees are more likely to detect red flags before they escalate into serious issues. Frequent audit committee meetings strengthen oversight. Active and engaged committees are more likely to detect red flags before they escalate into serious issues. Board gender diversity brings measurable benefits. The inclusion of women on boards leads to more balanced decisions and improved financial disclosures. Ownership concentration affects governance quality. Companies dominated by a few large shareholders often experience weaker board independence, reducing checks on management and risking minority shareholder rights.

Taken together, the message is clear: firms with strong governance structures are more transparent, more accountable, and more appealing to investors. Well-structured governance leads to more accurate and trustworthy reporting. These qualities are not only good for business but essential to the health of Ghana’s financial markets and the restoration of public trust. Over time, they contribute to greater market stability and sustained investor confidence.

From a policy perspective, the study recommends strengthening governance standards not only to improve profitability but also to safeguard Ghana’s financial stability. Enhanced governance boosts operational efficiency, strengthens risk controls, and builds investor confidence. It protects public funds, ensures compliance, and creates a climate conducive to long-term, sustainable growth.

The study offers several recommendations to management to strengthen corporate governance and improve financial reporting, based on empirical evidence from Ghanaian firms. Firstly, audit committees should be reconstituted to include independent, financially literate members with clearly defined oversight mandates. This aligns with the study’s findings that such independence significantly enhances reporting quality. Moreover, boards should champion diversity by integrating qualified women into strategic decision-making roles. The research highlights a positive association between gender diversity and improved financial disclosures. In addition, regular board and audit committee meetings should be scheduled with structured agendas focused on oversight and compliance. Frequent meetings help strengthen monitoring and facilitate early detection of irregularities. Furthermore, periodic governance audits should be conducted to assess board effectiveness and drive continuous improvement. This proactive measure reinforces internal accountability and transparency. Finally, firms should collaborate closely with regulators to remain current on evolving corporate governance codes and financial reporting expectations. Such engagement enhances compliance, fosters mutual trust, and builds investor confidence.

Consequently, by adopting these measures, corporate leaders can play a transformative role in restoring public trust, boosting market performance, and positioning Ghanaian firms for long-term success.

Publication Details

This study is published in the International Journal of Economics and Financial Issues. Full details of the study, methodology, analysis, and recommendations can be found in Volume 10, Issue 1. DOI: 10.32479/ijefi.8874

About the Author

Dr. John MacCarthy is a lecturer in the Faculty of Accounting and Finance at the University of Professional Studies, Accra, where scholarship meets professionalism.

Contact

Email: [email protected]

Mobile: 0246273579