President John Dramani Mahama

President John Dramani Mahama

President John Mahama’s Big Push Agenda presents a bold vision for Ghana’s infrastructure, promising a $10 billion investment in roads, energy, health, education, and other critical sectors.

While this ambitious plan is crucial for economic transformation, its success will largely depend on how it is financed. Given Ghana’s current fiscal constraints and high debt levels, innovative and sustainable financing strategies are required to ensure that the “BigPush” does not overburden the country’s economy.

In this article, I discuss two strategies I believe can help streamline and finance deals. One of the most effective financing models Ghana can adopt is asset recycling, an approach that has been successfully implemented in countries like Australia.

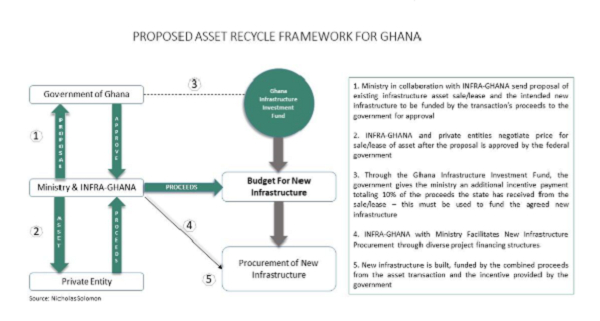

This strategy involves privatizing select state-owned assets, reinvesting the proceeds into new infrastructure projects, and ensuring efficient management of funds through institutions like the Ghana Infrastructure Investment Fund (GIIF).

The other is what I term as INFRA-GHANA, a dedicated infrastructure procurement state agency, responsible for managing the PPP Act, researching & developing investable pipeline infrastructure projects, and procuring infrastructure assets on behalf of the government of Ghana.

Asset Recycling: Unlocking Capital for Infrastructure Growth

Ghana’s infrastructure is aging, and significant new investments are needed to bridge the gap. Raising additional revenue through increased taxation is one way to address this urgent challenge, but both the government and the public remain hesitant to take this route.

However, there is another approach—Asset Recycling. Infrastructure asset recycling involves the monetization of existing public assets through sale or lease to the private sector, with all funds received being reinvested in new infrastructure.

Asset recycling offers the opportunity to provide newly needed infrastructure without adding to public debt, all while maintaining or potentially improving existing infrastructure service delivery.

The Ghanaian government owns several high-value assets that can be partially or fully privatized to raise significant capital. Some key candidates for privatization or concession agreements include:

Electricity Company of Ghana (ECG) – A strategic partnership and equity release with and to a private operator could improve efficiency and unlock much-needed investment in Ghana’s power sector.

Kotoka International Airport (KIA) – Several global airport operators are seeking expansion opportunities, and a long-term lease or full privatization could generate billions for infrastructure development.

University of Ghana Medical Centre (UGMC) & Ridge Hospital – Converting these healthcare assets into concession agreements could enhance service delivery while freeing up government resources for new projects.

Table 1 Asset Recycling Framework Proposal