Yesterday, the news media in Ghana carried a story about a criminal complaint made by Swiss energy trader, Petraco, to Ghana’s organised crime agency, the Economic & Organised Crime Office (EOCO), against junior oil explorer, Springfield; its media darling founder, Kevin Okyere; and other senior executives and corporate affiliates.

The complaint is dated the 16th of May, 2025, but appears to have been received on 10th June, 2025 by the EOCO, and the Criminal Investigations Department (CID) of the Ghana Police Service.

Springfield denies all criminal wrongdoing and contends that there is no scandal, only a dispute of a purely civil and commercial nature.

The complaint is in two parts, and covers the following issues:

A $100 million loan facility that Springfield borrowed from Petraco to invest towards pushing forward the “unitisation” (a technical term for merging two or more oil finds or fields) of its Afina oil find and the proven Sankofa – Gye Nyame field offshore Ghana. The lease owners of Sankofa – Gye Nyame are Eni, an Italian energy giant, and Vitol, a large Swiss energy trading company. A ~$29.321 million oil cargo (MT Hatay; 6th September 2024) that Petraco facilitated for GMP Energy, a company majority owned by Geena Malkani, Springfield’s second-in-command. GMP signed a deal with EDURC (acting at Petraco’s behest), collected the cargo, and sold it on to BOST, Ghana’s state-owned downstream petroleum player under the country’s murky and controversial Gold-for-Oil scheme. Petraco insists that GMP pocketed the funds and embarked on a fraudulent scheme to deny receipt of the money from BOST.

The Unitisation Loan

According to Petraco’s complaint, Springfield drew down the first tranche of the loan facility in two disbursements of $25 million each (amounting to a total of $50 million) under false pretences of using the funds to advance the forced merger of its Afina find and the Sankofa Gye Nyame fields, but instead misapplied the money.

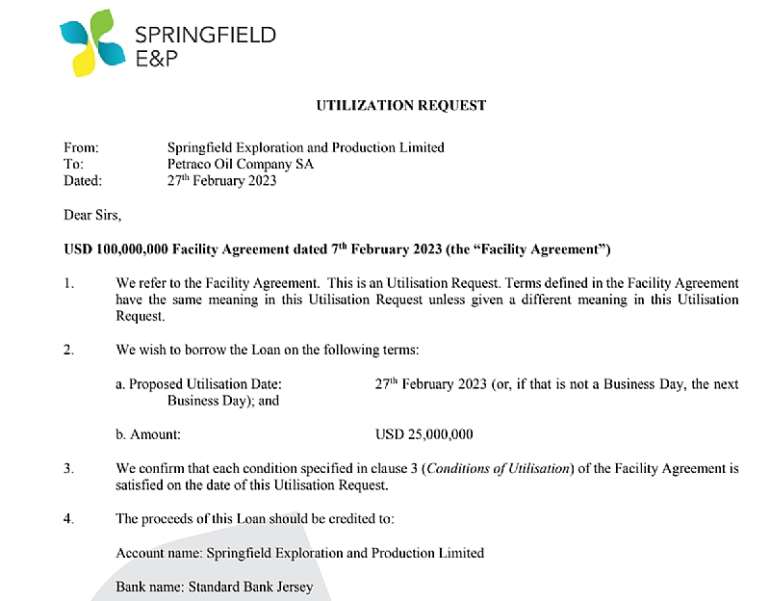

According to the terms of the 7th February 2023 loan contract, a carefully crafted 56-page document that I have reviewed, the $50 million was due for repayment on the last business day before the Maturity Date in the contract should unitisation fail to occur. Were unitisation to be successful, the terms of the deal would shift to the supply of oil from the unitised fields to Petraco.

The “maturity date” is defined in the agreement as 18 months after the first tranche’s release or 12 months after the disbursement of the 2nd tranche of the loan facility.

Springfield made its withdrawal request on 7th February, with disbursement scheduled on 27th February, 2023.

Consequently, the latest payment timeline would be August 2024. Springfield has thus been in default for roughly 10 months going strictly by the Agreement.

Kennedy Noonoo, Springfield’s Corporate Affairs Manager, responded to my queries with a statement. The relevant extract says as follows:

“Prior to the execution of the Facility Agreement, Petraco and its third-party consultants/experts conducted thorough legal and technical due diligence on SEP [Springfield] and the West Cape Three Points Block 2. SEP fully cooperated with Petraco and its consultants/experts by providing them with all the relevant data, materials and information required to enable them conduct their due diligence. It is upon satisfactory conclusion of the due diligence that SEP and Petraco executed the Facility Agreement with the subsequent disbursement of the initial USD 50 million.”

In respect of the very clear payment timeline in the contract, Springfield does not explain why it remains in default nearly a year later and what it is doing to imminently cure the default.

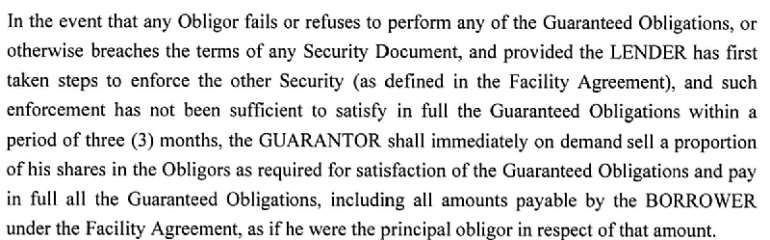

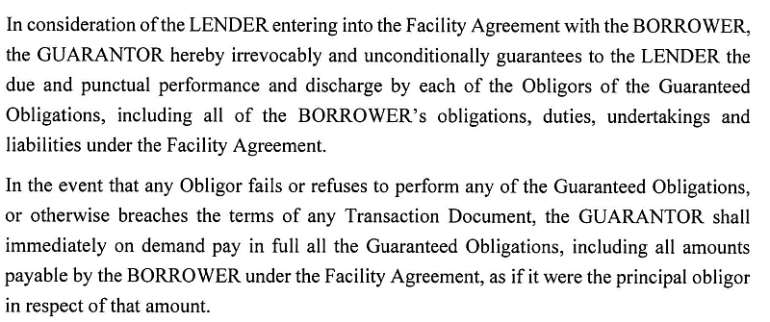

Springfield’s statement appears to suggest that the agreement itself provides the remedy. According to documents meant for discovery in upcoming arbitration processes, Kevin Okyere issued a personal guarantee to sell a portion of his shares in Springfield to generate the necessary cash to pay back Petraco should the corporate guarantee issued by Springfield’s key affiliate (Springfield Energy Limited, the legacy trading company founded by Kevin before he created Springfield Exploration & Production Limited to find and commercialise oil in the WCTP-2 block) prove inadequate.

Here is the relevant extract from the Springfield statement:

“SEP provided security for the USD100 million loan, including a charge over 10% of the issued shares of SEP. Even though only USD 50 million of the loan was disbursed, Petraco has register the entire 10%, which was to cover the entire loan amount.”

Here is the relevant portion of Kevin’s guarantee:

And from the text of Springfield’s key affiliate guarantee:

It is a fact that for ten months now, Springfield’s key affiliate has not been able to pay back the borrowed money on behalf of Springfield, despite its contractual assurances. The question is why hasn’t Kevin proceeded to liquidate a portion of his shares in Springfield’s only operational key affiliate to obtain the funds to pay back Petraco?

Springfield appears to suggest that the charge over its parent’s equity should be over 5% instead of 10% of the outstanding shares, and that this is the source of the dispute.

To be honest, on a plain reading of the guarantee, as the reader can see for themselves, the assurance seems to be a simple one of selling whatever portion of shares is necessary to restore the lender to their just entitlements.

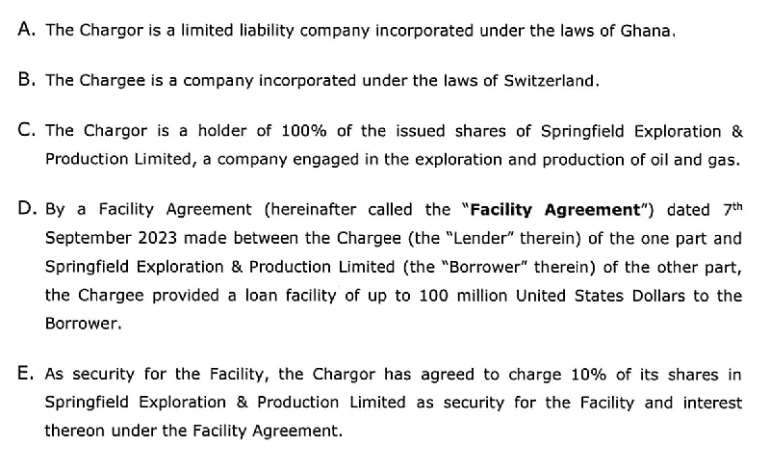

Springfield’s latest comments appear related to the separate and consequential charge agreement between Springfield Partners Ghana Limited (the holding company that is Springfield’s parent and of which Kevin owns 90% and his second-in-command, Geena, 10%, through her GMP vehicle).

That agreement between Springfield’s parent and Petraco does specify a 10% figure, though not in direct proportion of the funds advanced. In fact, the express language is “up to $100 million.” See the relevant extract below.

Whilst Springfield is right in putting the actually disbursed loan amount at $50 million, the actual amount of indebtedness exceeds this figure due to the SOFR-based interest arrangement. As of April 8th, 2025, when Petraco wrote to the Minister of Energy to inform him about encumbrances on the shares of Springfield, the principal and interest combined stood at: $62,757,214.35.

At any rate, those determinations shall be made by the arbitral panel. Our interest is strictly in relation to the public policy dimensions, which shall become apparent shortly. Bear with me.

For now, I must express surprise that despite a series of correspondence initiated by Petraco, the Ghanaian authorities, from the Minister to regulators to various investigative bodies, are all completely incapable of responding. It seems as if giant metal locks have been used to clamp the pens and faculties of all political and regulatory actors in the country.

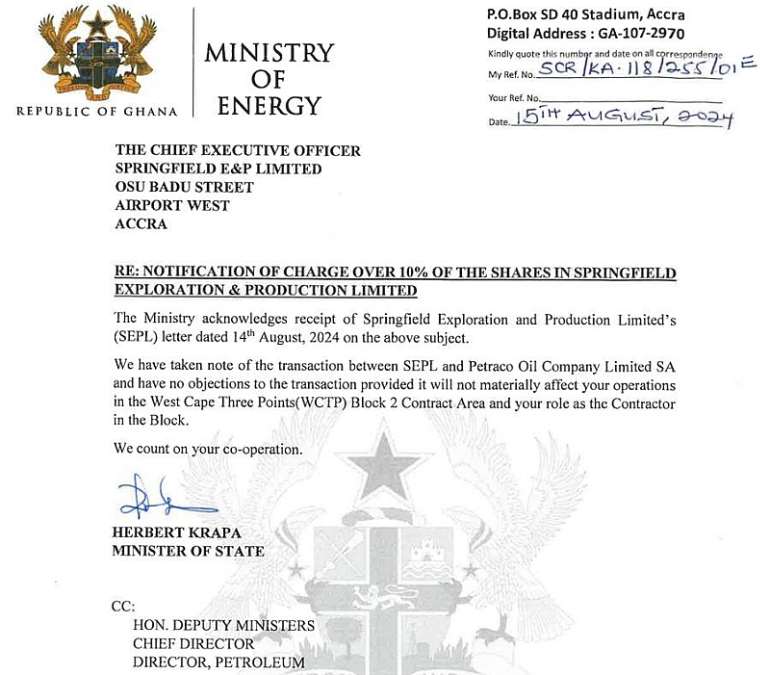

What a contrast to the situation when Springfield was in desperate need of the cash. The Minister of Energy responded within 24 hours of Springfield’s request for a no-objection notice.

As I said, we will return to this issue.

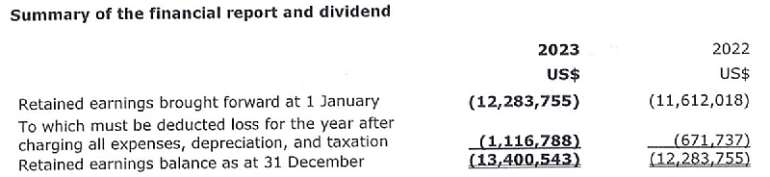

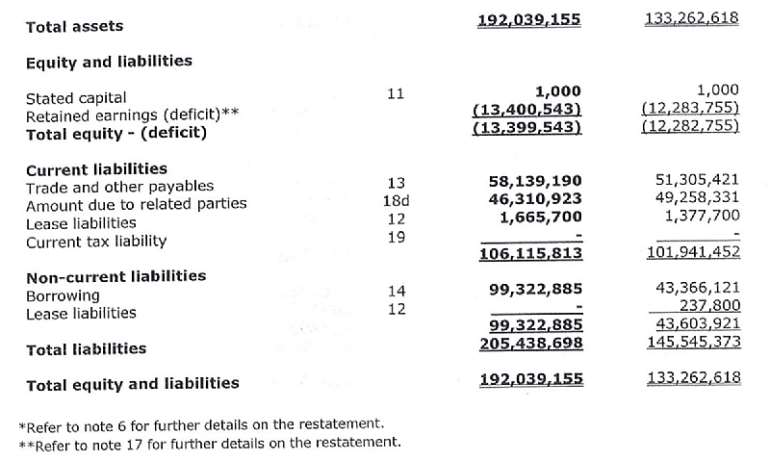

Petraco’s anxiety, which is driving the petition-writing, becomes apparent when you dig into the books of Springfield’s parent, whose shares have been charged to the benefit of Petraco.

As a serial loss-maker, it is hard to imagine the company generating any cashflow to service its major liabilities, especially now that there is some ambiguity surrounding the commerciality of its only serious asset, Afina, following limited appraisal.

Perhaps, more worryingly, valuations in 2020 (NPV10) of $2.9 billion notwithstanding, the company currently has negative equity.

It follows then that Petraco may ultimately need to invoke the personal guarantee and corporate guarantee issued respectively by Kevin Okyere himself and Springfield Energy Limited, the legacy trading company he founded, to get anywhere close to retrieving their $62 million.

The attitude of the Ghanaian authorities in response to the company’s petitions, however, raise serious concerns about the effectiveness of pursuing recovery in the Ghanaian jurisdiction.

The MT Hatay Cargo

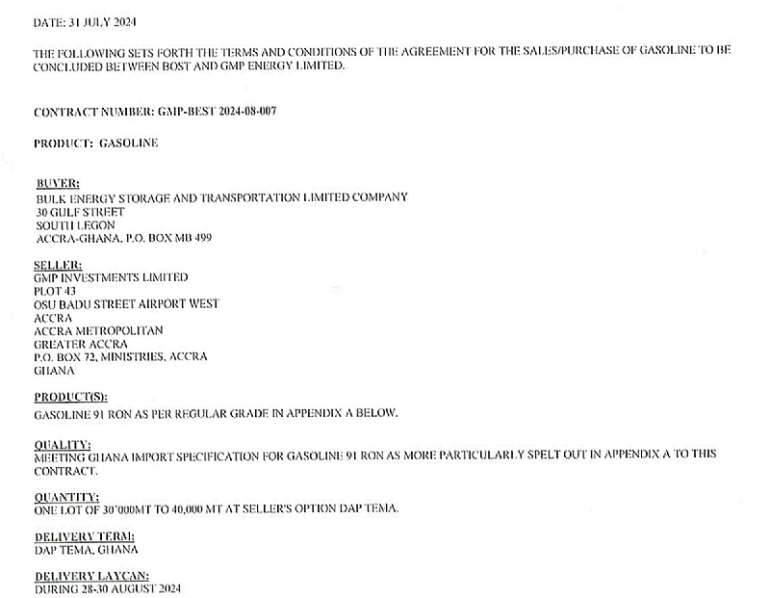

In July 2024, before the loan facility was due, Springfield’s affiliate, GMP, majority owned by Geena Malkani Punjabi, Kevin’s close confidante and business partner, and the second-in-command at Springfield, entered into an agreement with BOST for the sale of gasoline (“petrol”) under Ghana’s murky Gold-for-Oil program.

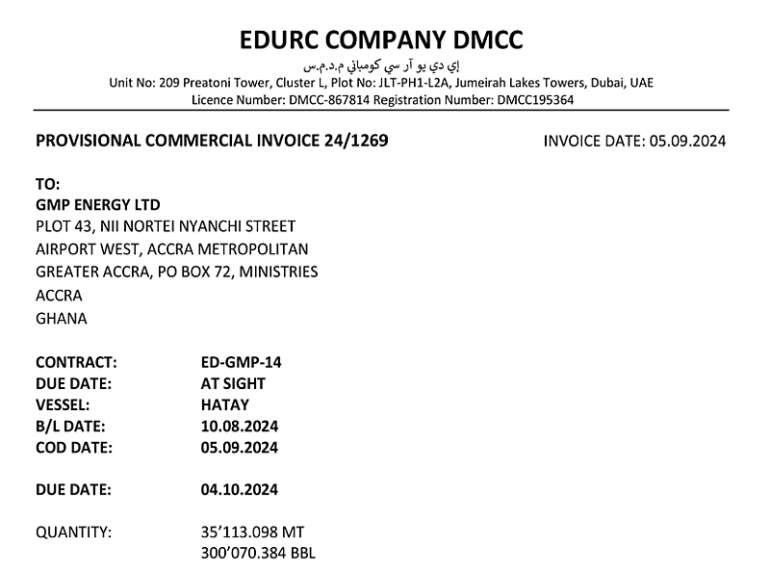

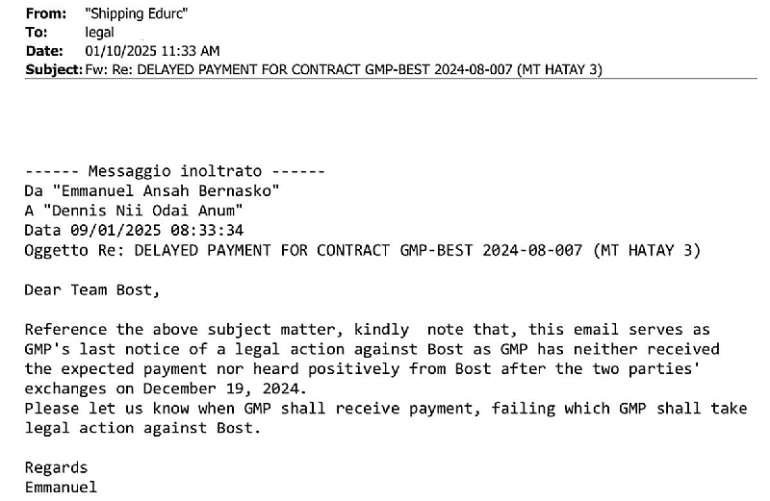

Subsequent to that, GMP entered into a contract with EDURC of Dubai through the facilitation of Petraco, leading to a sale in September 2024.

Springfield/GMP having consented to an assignment of EDURC’s rights to Petraco in July 2024, an agreement was subsequently executed between the latter two parties to ratify.

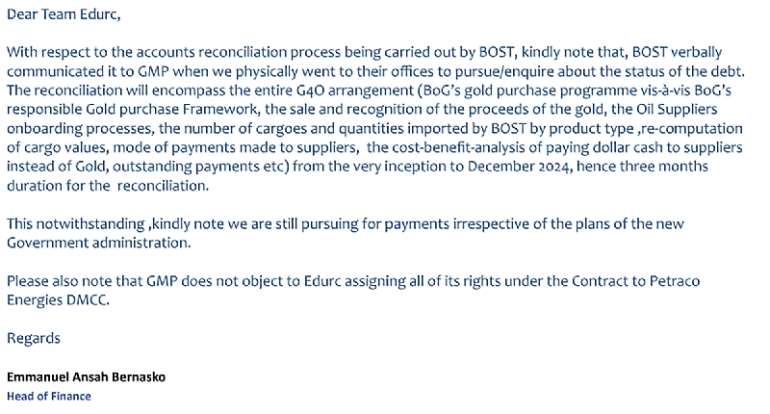

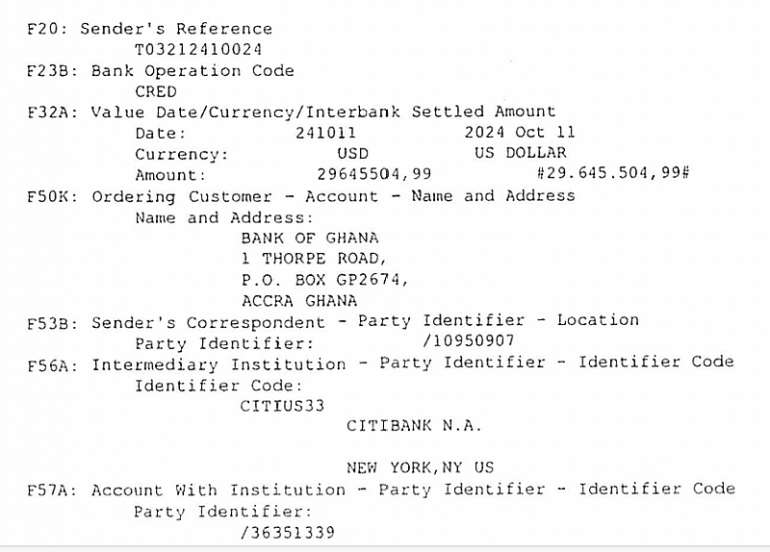

Banking records show that BOST paid on time, in October 2024.

Yet, GMP refused to remit the funds.

From the records I have seen, GMP and Springfield commenced a cat and mouse game with the full complicity of BOST.

In January 2025, a senior official of Springfield, as part of the elaborate ruse, wrote to BOST threatening legal action for non-payment.

BOST merrily played along.

These games apparently distracted Petraco for many months until its intelligence revealed the underhand dealings, at which point it moved to commence the petitions and the various actions it has since taken.

The accusations of “fraud”, if they have any merit, thus implicate BOST, a state-owned enterprise, with serious implications for Ghana’s reputation.

Public Policy Context

Some readers would recall the relentless push by IMANI and ACEP to force the government of Ghana to abandon the forced unitisation program that would have seen Springfield’s Afina compulsorily merged with the ~$7.5bn Sankofa Gye Nyame field and 55% of the combined interest handed over to Springfield (for a quick refresher, see here and here.)

Others may also recall the incessant calls for reconfiguration of the Gold-for-Oil program to remove the shady and murky elements.

The Petraco – Springfield dispute, with its undertones of fraud and skulduggery, compels a serious reckoning with the public policy context.

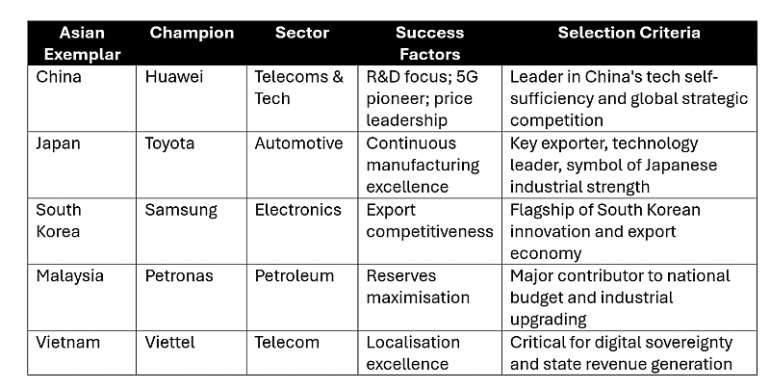

Many were the observers who reached out to myself and others within the IMANI-ACEP circuit to caution us against standing in the way of Ghana’s resource-nationalist plans. We were told that Springfield was a national champion and that any criticism of the approach to unitise the fields despite the lack of economic and scientific rationale was unpatriotic. The evidence that has since emerged is that there is nothing “nationalist” about a program that does not meet national interest. It is clear that at the time that the country was aggressively pushing the unitisation agenda, even to the detriment of its investment climate in the oil and gas sector, Springfield was not building the financial foundation that would make it a credible national champion in the classical sense of that term. We have come to that assessment by painstakingly examining its corporate books and operational track record before and after the forced unitisation debacle. National champion selection is a very sophisticated exercise that must always be driven by serious national interest, analytical discipline, and the willingness to continuously monitor, review eligibility, reward, and sanction. That is how Japan, Korea, and now Vietnam and China, successfully used the model to support the likes of Huawei and Samsung.

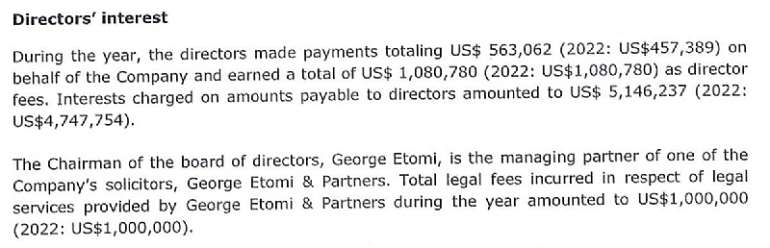

Even if Springfield had National Champion DNA within its tissues, and there is no denying the risk-taking appetite and entrepreneurial spunk of Kevin Okyere and Geena Malkani, Ghana simply lacked the policy environment to nurture it properly to play its strategic role. The absence of a national learning culture and the katanomic policy environment led to a bumbling process of driving forward unitisation without any effort to monitor and track the performance of Springfield in order to maintain eligibility for continuous national champion sponsorship. Were such a monitoring and surveillance program to be in place, it would have become apparent that once it became clear that the government would push unitisation at all cost, Springfield’s operational performance, per its financial records, significantly declined, raising questions about whether the funds borrowed against oil from the yet-to-be-unitised fields were all judiciously applied to advance business goals. Despite financial challenges, Springfield continued to pay the law firm of a Director upward of a million dollars in fees in the 2023 financial year, and was paying actual Director fees of a similar amount.

Such large fees to Directors and related parties seem rather curious when the company was cutting auditing fees by nearly 50% to less than $17,500 by switching auditors, whilst jacking up corporate social responsibility spending from ~$9700 to nearly $380,000. Recall that accumulated losses at this point exceeded $13 million. In short, Ghana lacked the disciplining institutions for driving a national champion agenda. Thus, IMANI and ACEP were totally correct to be suspicious of the merits of the strategy. It is more likely that specific individuals in government, the same ones that were enthusiastic in representing to Springfield’s creditors that the company has the total support of the government, were only interested in parochial economic interests with no bearing on the national agenda or vision. The dramatic corroboration of our constant accusations against the Gold-for-Oil program, in light of BOST’s clear complicity in this whole murky Petraco-Springfield affair is cause for sober reflection about how governance is done in Ghana.

It is time for all of us in Ghana to recognise that supporting Ghanaian businesses to thrive and become torchbearers for the nation requires the discipline of policy, rules, and consistent review and evaluation. Otherwise, a noble mission is easily hijacked to advance the interests of a very small clique. There are even times when such hijacking can result in substantial damage to Ghana’s broader goals and ambitions.

Whilst some damage has already been caused by this Petraco-Springfield saga, not least to the country’s reputation, there is still a chance for some redemption. The government authorities that have gone silent and are refusing to respond to correspondence should snap out of their slumber, or coma, and show that Ghana is not, appearances to the contrary, a tinpot republic where the policy, legal, and regulatory regime is so completely incapacitated as to be rendered useless.

A fair and amicable settlement between Springfield and Petraco would do credit to the Ghanaian jurisdiction in the eyes of investors both local and foreign.

This is a developing story.