The talk of town the world over is the recent sweeping tariffs imposed by the Trump Administration on exports going into the US. This is a reciprocal tariff on all countries with some level of taxes on US goods exported into that country. The tariff, as announced by the Trump Administration was not uniform for all countries but based on the level of taxes imposed on US goods in that country.

Although Ghana was affected, it can be said that the US government was magnanimous as the country was in the lowest baseline tariff of 10%. Ghana is in the same bracket of the United Kingdom. Some countries were slapped with tariffs as high as over 40%.

Though this new policy shift presents a major challenge to Ghanaian businesses that export to the US, how deep is the cut on the total exports of Ghana?

US-Ghana Import and Export Trade

Recent data from Trend Economy reveals that the US accounts for just 4.6% of Ghana’s total exports, which is less than 5% of the total exports of the country. Interestingly, the US is not among the top 5 export destinations of Ghana.

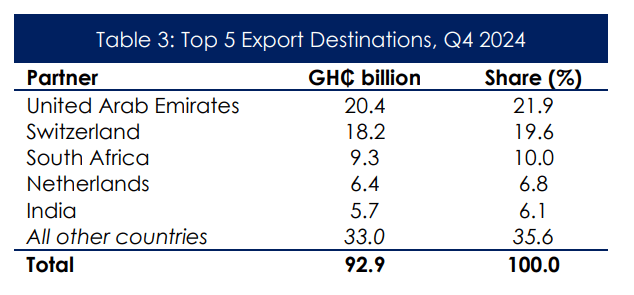

The Ghana Statistical Service‘s latest data also confirms that the US is not on the list of top 5 export destinations of Ghana. Per the latest data, the United Arab Emirates, Switzerland, South Africa, the Netherlands, and India are the top five export destinations of Ghana. These five countries account for about 64.4% share of the total exports of Ghana. While all other remaining countries, including the US, share the remaining 35.6%.

Source: Ghana Statistical Service

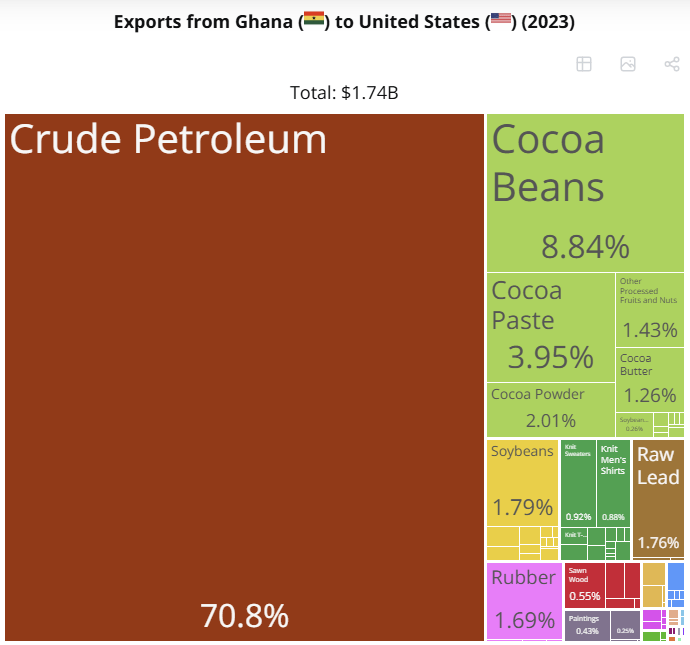

Ghana’s top exports to the US are crude petroleum, cocoa beans, and cocoa paste, while imports to Ghana from the US are cars, refined and crude petroleum, rubber, soybean, raw lead, etc.

In 2024, the total trade between the US and Ghana amounted to $2.1 billion. $967 million worth of the trade were goods exported to Ghana, and $1.2 billion were imports from Ghana to the US, resulting in a trade deficit of $204 million.

Possible Impact of the Tariff Hike on Ghanaian Exports to the US

Despite the low volumes of trade between the two countries, there is some level of impact that Ghanaian exporters will face following the tariff. These include;

Reduction in Competitiveness of Ghanaian Products in the US

Experts say the new tariff is an ad valorem tax, which will be paid by importers at the ports. The importers will then pass on the tax to the consumer, hence making the products relatively expensive. This tariff, when passed to the consumer, will make Ghanaian goods relatively expensive in the US and hence make them less competitive compared to similar products from countries with no tariffs. This is very concerning for Ghanaian exporters.

Possible Trade Diversion

With the 10% tariff on Ghanaian products, US importers who trade with Ghana may seek alternative countries that might be less affected by the tariff. This will spell trouble for Ghanaian exporters since it will lead to a decline in demand for Ghanaian products, hence threatening job losses.

Decline in Revenue

Should the demand for Ghanaian products decline, businesses in Ghana heavily reliant on the export to the US are at risk of huge revenue losses. This will threaten the sustainability of businesses. Those in sectors such as cocoa processing, shea butter, and handicrafts among others, are highly vulnerable in this situation.

Supply Chain Disruptions

The tariff hike could disrupt existing supply chains, forcing Ghanaian exporters to reconsider their pricing strategies and supply networks. This could also lead to increased costs, further straining profit margins.

Remedial Measures for Ghanaian Exporters

To mitigate these possible impacts, there are some remedial measures Ghanaian exporters can take to continue to stay in business. These include;

Diversification

Given that world trade is virtually a free market and Switzerland, South Africa, UAE, China, and India are the top export destinations for Ghana, businesses should focus on strengthening trade relations with these markets. Expanding into emerging markets with favorable trade agreements can also help offset potential losses.

Leverage on AGOA and AfCFTA for Intra-African Trade

Exporters should explore leveraging the African Continental Free Trade Area (AfCFTA) to increase intra-African trade and reduce reliance on U.S. exports. Additionally, exporters should work with the government to negotiate trade benefits under the U.S. African Growth and Opportunity Act (AGOA), which provides duty-free access for certain products.

Enhance Productivity and Cost Efficiency

Ghanaian exporters should explore ways to reduce production and logistics costs to remain competitive despite the tariff hike. Investing in modern processing techniques, automation, and efficient supply chain management can help mitigate financial losses.

Governmental Intervention

The Ghanaian government should engage in diplomatic negotiations with the U.S. to seek tariff exemptions for key industries. Providing financial incentives, subsidies, or export credit facilities to affected businesses could also help cushion the impact.

The Bottomline

Considering that the U.S. is not one of Ghana’s top five export destinations, as it accounts for just 5% to 6% of total exports, the overall macroeconomic impact might be contained. However, specific industries and businesses heavily reliant on the U.S. market will bear the brunt of the policy change. Meaning: While the tariff hike presents an immediate challenge, its overall impact on Ghana’s economy may be limited.

Economist Dr. Theo Acheampong further reveals that “Ghana will feel the second round of inflationary cost pass-through, not because of imports and exports with the US but in other countries like China and others, whose input costs may rise and will be felt by all economies, including Ghana.”

However, all hope is not lost as diversification, adding value to exports, improving efficiency, and leveraging trade agreements can help Ghanaian exporters to navigate this challenge effectively. Proactive government intervention and private-sector adaptability will be key to sustaining Ghana’s export growth despite the changing trade landscape.

Source: thehighstreetjournal.com