Dr. Johnson Pandit Kwesi Asiama, the newly appointed Governor of the Bank of Ghana (BoG), has announced plans to implement a new foreign exchange law as part of efforts to stabilize the cedi and curb currency speculation.

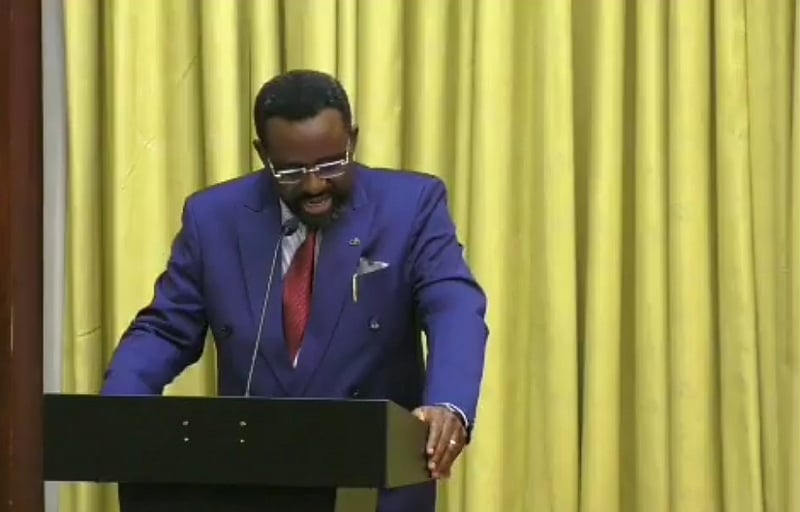

Dr. Asiama stated during his speech at his swearing-in ceremony in Accra on Tuesday, February 25, that the days of exchange rate volatility must come to an end.

“The days of currency speculation and exchange rate instability must come to an end, and we are poised to ensure this happens,” he declared.

He stated that, under his leadership, the BoG will “engineer a well-functioning and stable foreign exchange market to support economic activity.”

To accomplish this, Dr. Asiama stated that the new foreign exchange law will replace the current Foreign Exchange Act 2006 (Act 723) and implement targeted market operations to prevent FX leakages while strengthening the central bank’s reserve management.

His administration would also use Ghana’s gold reserves and strategic foreign assets to boost the cedi.

He stated that improvements to the Bank’s Domestic Gold Purchase Programme will increase openness and efficiency in gold transactions.

Aside from exchange rate stability, the new BoG governor outlined five other priorities.

These include recalibrating monetary policy to better manage inflation, strengthening the regulatory framework to promote financial intermediation, improving coordination between fiscal and monetary policies while maintaining the BoG’s independence, and reversing the central bank’s negative equity position to maintain financial stability.

Dr. Asiama emphasized the importance of increasing financial inclusion as a means of promoting economic growth and alleviating poverty.

He expressed confidence that Ghana is well-positioned to become a regional hub for digital assets and financial technology, and promised to execute a digital strategy to modernize the country’s financial sector.

“We will continue to support initiatives that expand access to financial services, leveraging fintech and mobile banking solutions to broaden the scope of access, especially in underserved communities,” he assured.