Despite recent signs of consumer inflation stabilizing, the reality on the ground suggests a more complex and unsettling picture. A closer look at Ghana‘s price trends reveals brewing cost pressures beneath the surface. While consumer inflation appears to be holding steady, producer prices tell a different story – one of rising costs and financial strain on businesses.

This growing divergence between consumer and producer prices signals that businesses are still grappling with high operational expenses, and the so-called stability in consumer prices may be a fleeting illusion.

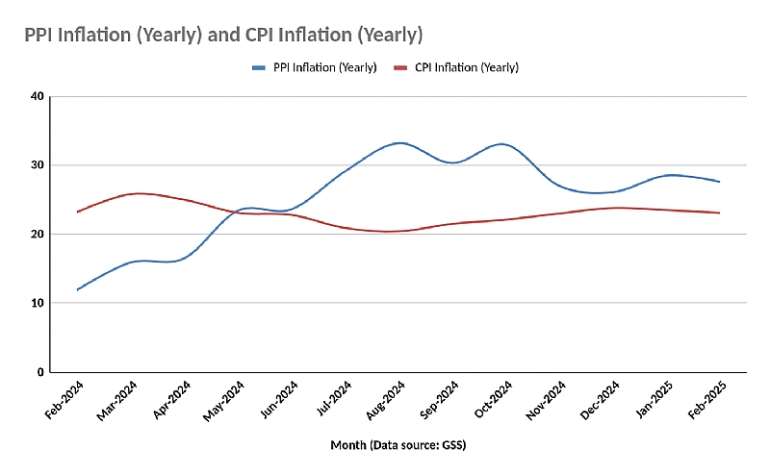

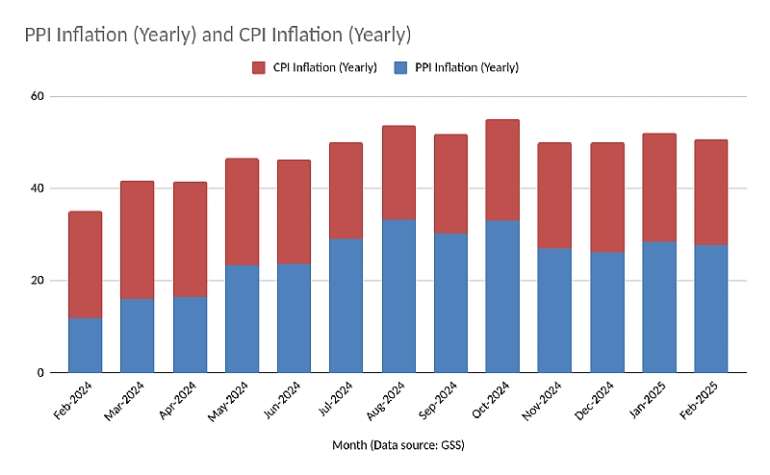

Ghana’s consumer price inflation for February 2025 stood at 23.1%, barely changing from 23.2% a year earlier in February 2024. On the surface, this suggests that price increases at the consumer level have slowed. But zoom in on producer price inflation, and a different trend emerges, one that tells a story of persistent cost pressures on businesses that could eventually spill over into consumer prices.

The Producer Price Index (PPI) for February 2025 soared to 274.4 from 215.0 in February 2024, reflecting a year-on-year producer inflation rate of 27.6%. This sharp rise far outpaces consumer inflation and raises serious concerns about future price movements.

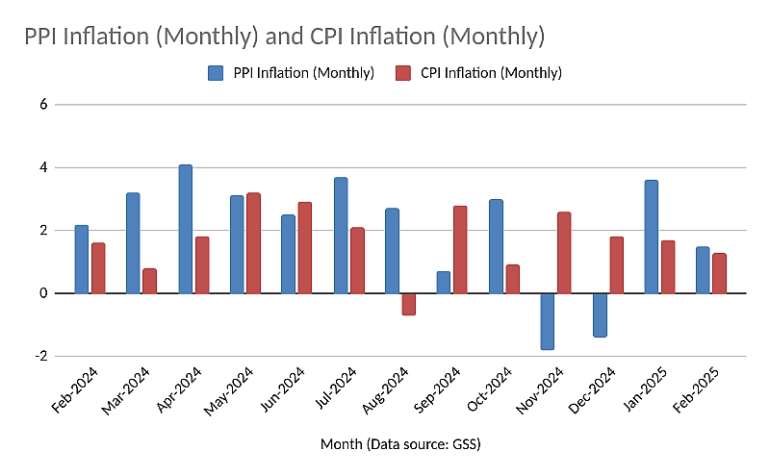

Over the past year, PPI has demonstrated a volatile pattern, climbing steeply from 215.0 in February 2024 to 269.5 in October 2024 before dipping slightly in late 2024 and resurging in 2025. Monthly fluctuations in producer inflation further highlight this instability, while February 2025 saw a 1.5% month-on-month increase, January 2025 experienced a 3.6% jump, reinforcing the view that production costs remain unpredictable.

By contrast, consumer inflation has remained relatively stable, fluctuating within a narrow range between 23.2% in February 2024 and 23.8% in December 2024, before slightly dropping back to 23.1% in February 2025. However, despite this apparent steadiness, the gap between PPI and CPI is widening, an indication that businesses may not have fully transferred their rising costs to consumers yet.

Looking at the data over the past year, July 2024 recorded the highest year-on-year PPI at 33.2%, a period when businesses faced escalating costs of production, driven by exchange rate depreciation, rising fuel prices, and increased tariffs on utilities. Though PPI later declined to 27.0% in November 2024, this figure remains significantly above consumer inflation, showing that businesses are still dealing with higher costs even if they have temporarily absorbed them.

The divergence in trends between consumer and producer inflation suggests that businesses are under pressure. While consumer inflation appears stable, the underlying reality is that producer costs remain high and volatile. The question is: how long can businesses continue to shield consumers from the full impact of these rising costs?

With the cedi depreciating by nearly 6% against the U.S. dollar in January 2025, the cost of imported raw materials has increased, directly influencing production expenses. Fuel prices have also remained high, with petrol and diesel selling between GH₵13 and GH₵15 per liter, further driving up transportation and logistics costs. Electricity tariffs and the cost of borrowing remain significant concerns for businesses, making it increasingly difficult for them to maintain price stability.

If these pressures persist, the illusion of stable consumer inflation could soon break. Businesses may be forced to pass on the costs they have been absorbing, leading to a new wave of price increases that could reverse any perceived progress in stabilizing inflation.

Source: thehighstreetjournal.com