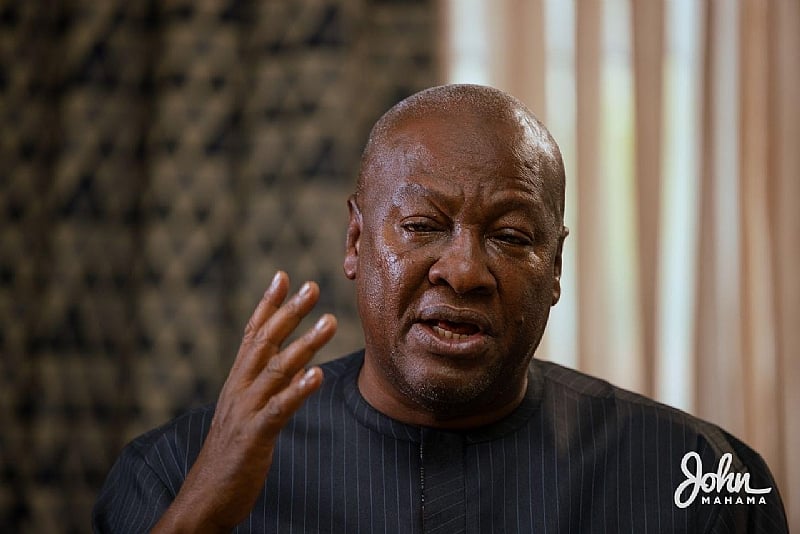

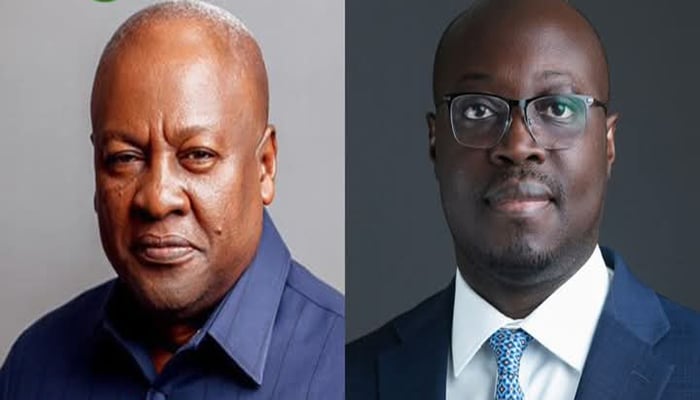

All too soon, President John Dramani Mahama has steered the affairs of the country for exactly 6 months, marking the first half of his first year in office. It appears the tone of his governance has begun to settle as he ushers into the second half of the year.

It is a known fact that a lot has happened, especially on the economic front, in the first six months. Ghanaians are seeing early signs of stability, renewed confidence, and a more hopeful economic narrative.

As the curtain falls on the first half of 2025, a combination of macroeconomic gains, improved investor sentiment, and meaningful international support has marked the period as one of modest but significant progress.

Significant Economic Milestones

Going back in memory lane, President Mahama inherited a fragile economy at the start of the year. However, the Mahama administration has managed to arrest the sharp volatility that plagued the cedi, restoring relative stability to Ghana’s currency.

The Bank of Ghana’s prudent monetary measures, coupled with improved forex inflows, have helped the cedi hold firm, creating much-needed predictability for businesses and importers alike. Currently, the cedi that was trading around GHC 15 at the start of the year is now trading around GHC 10.

Inflation has also continued to walk a steady path of downward trend. This was mainly driven by tight monetary policies by the Bank of Ghana, supported by tight fiscal discipline and improved food supply in key regions. For ordinary Ghanaians, this has translated into some relief at the pump and at the market stall, although concerns about job creation and disposable income still linger. From 23.5% in January, the economy is entering the second half of the year with a lower rate of 18.4%.

Interest rates have also shown signs of softening, with T-bill rates falling for consecutive weeks, indicating improved investor confidence in government debt and a possible shift toward more affordable borrowing costs for businesses. From an average of 30% in January, the government has managed to bring it down to an average of 15%, significantly cutting the cost of borrowing and the rate of debt accumulation of the state.

Massive International Confidence and Support

Perhaps the biggest vote of confidence came from the World Bank, which committed a new financial package to Ghana, aimed at supporting development priorities and propping up budgetary needs. The funding has provided a cushion for government spending while signaling to global investors that Ghana remains a credible economic partner.

Equally significant was Bill Gates’ grant to Ghana’s health and education sectors. This signals a strong endorsement of President Mahama’s commitment to human capital development. The gesture not only injects critical funding into underserved areas but also enhances Ghana’s global development profile.

To crown it all, Fitch Ratings upgraded Ghana’s sovereign credit outlook, citing improved fiscal consolidation and a steady return to macroeconomic stability. The improved ratings outlook is expected to lower Ghana’s borrowing costs and open more doors for external financing at better terms.

What Lies Ahead?

As the second half of the year begins, attention is now shifting from early recovery to how sustainable the gains will be. The government will be under pressure to maintain the fiscal discipline that has so far brought inflation and interest rates down.

The task is going to be a daunting one, as already, some labour unions are agitating, making huge financial demands that can put fiscal prudence in disarray.

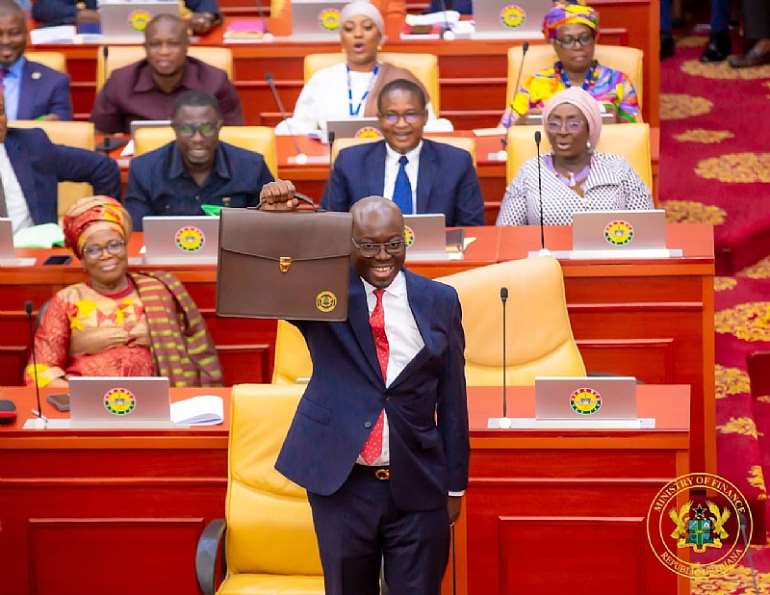

The upcoming Mid-Year Budget Review, expected later this month, will be a critical test. With a relative stability at the macro level, the expectations are high on how the administration will balance its ambitions for growth and development with debt obligations and the meagre domestic revenue.

In the second half of the year, inflation and currency stability will come under a serious stress test. Will the inflation and the cedi’s anchor hold? This is because this part of the year is going to witness increased spending on social programs, infrastructure, and debt servicing, alongside the anticipated import boom ahead of the Christmas season. This could stretch the budget.

The VAT reform is also just around the corner, and it is expected to be introduced in September. The policy could broaden the tax base and increase domestic revenue, but risks public resistance if not communicated properly.

Reentry into bond issuance is expected in September, which will mark a significant milestone to gauge investor confidence. It will tell a major story of how markets perceive Ghana’s medium-term fiscal credibility.

Will the Goodwill Last?

So far, so good, the administration of President John Mahama is still basking in the goodwill of the people. The public sentiment around the Mahama administration has been very optimistic. The return of economic stability, improved international relations, and decisive leadership have all boosted the government’s image.

However, goodwill, as history shows, can be fleeting, especially if economic relief does not translate into jobs, better wages, and social progress.

Finance Minister Cassiel Ato Forson remains a key figure in the administration with his “Forson Doctrine,” rewriting the economic recovery narrative. His technocratic approach and fiscal discipline have been central to the turnaround story. The question, however, is whether he will continue in that role as the challenges ahead become more political than technical.

The Bottomline

The first six months of the Mahama administration have been largely reassuring, a phase marked by stabilization and recovery. But the second half of the year will likely determine the administration’s legacy and direction. Will gains be sustained, deepened, or eroded? Will reforms meet resistance or lead to a new era of inclusive growth? Only time will be the best judge.

Source: thehighstreetjournal