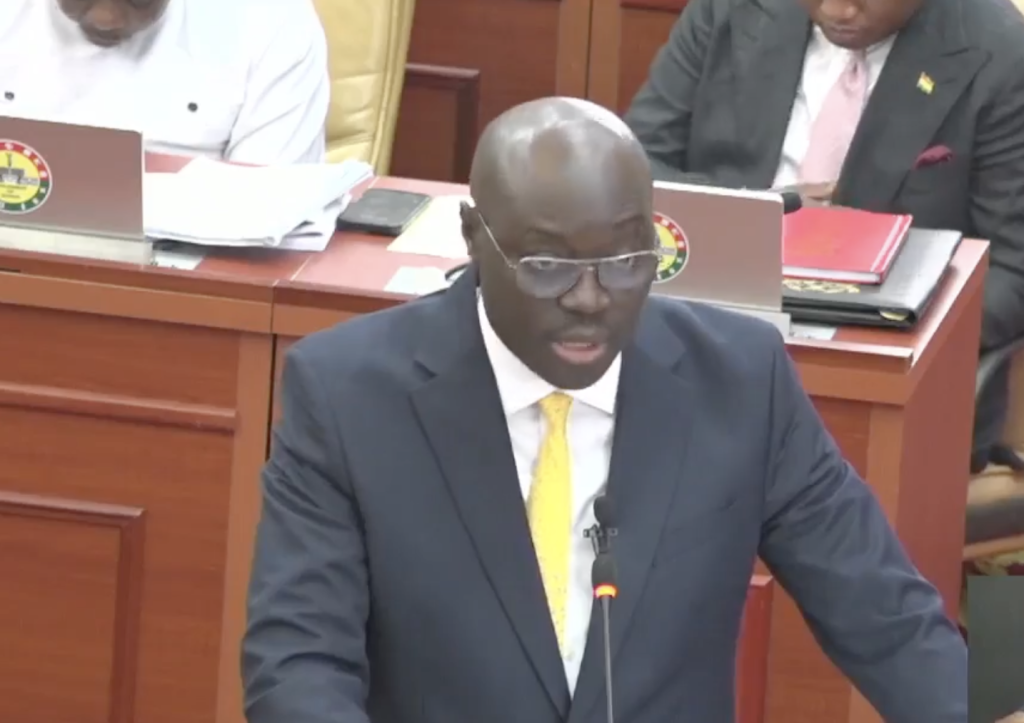

The Finance Minister Dr. Cassiel Ato Forson has announced that the government will soon scrap the existing VAT Flat Rate Scheme as part of efforts to reform Ghana’s tax system.

Presenting the 2025 Mid-Year Budget Review in Parliament, Dr. Forson said the flat rate will be replaced with a unified VAT rate aimed at simplifying the tax regime and reducing the burden on businesses.

“We are taking steps to remove the VAT flat rate and introduce a unified VAT rate structure,” he said. “This reform will help lower the effective VAT rate and ease compliance for businesses.”

Dr. Forson also reiterated that the COVID-19 Health Levy and the National Health Insurance Levy (NHIL) will be scrapped as part of the same reform process.

“These two levies have served their purpose and will be removed,” he emphasized. “This is part of our broader effort to provide relief for businesses and consumers, while improving the efficiency of the tax system.”

The Finance Minister noted that the change is in response to long-standing concerns from the business community and tax experts who argue that the flat rate distorts pricing and affects competitiveness.

According to Dr. Forson, the new VAT system is expected to improve transparency, enhance revenue collection, and support economic growth.

He said the measures form part of a comprehensive plan to restore macroeconomic stability and drive growth in the medium term.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.